The U.S. government passed a coronavirus relief bill today that's thought to be the largest of its kind in history as Washington tries to dampen the sharp economic decline that's expected from the spreading pandemic.

While the plan will provide one-time payments to individuals as well as tax-breaks to small businesses, select industries will benefit as well by way of substantial capital infusions. This would include struggling airlines as well as overstretched hospitals and, while these much-needed funds will help these industries, the negative impact of the coronavirus may well outstrip the relief bill's efforts to buffer them from financial losses.

Of more interest is the $2.5 billion allocated to the defense industry, which will help prop it up after the government invoked the Defense Production Act, forcing companies to provide goods and services in response to COVID-19 upon request.

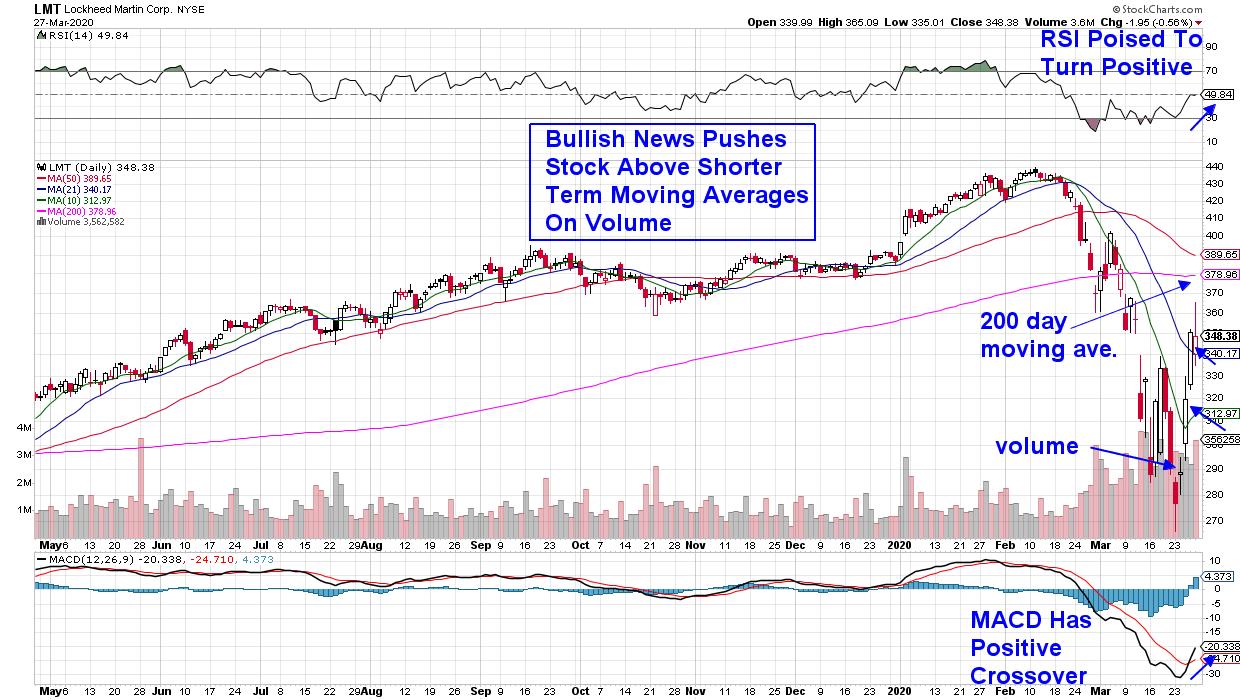

DAILY CHART OF LOCKHEED MARTIN (LMT)

This would include companies such as defense contractor Lockheed Martin (LMT), which has kept its plants running as the company plays an essential role in national security. The stock is currently emerging from a deeply oversold position following its 37% plunge from a February high in price.

LMT began this week's rally ahead of the Relief Bill signing, as news of being awarded two missile contracts worth over $1.5 billion had analysts raising earnings estimates. The stock has bullishly broken back above both its 10- and 21-day moving averages, with the next area of possible upside resistance being its 200-day moving average, which is 9% away.

A quick look at the 2008 bear market shows that top-performing defense-related stocks held in relatively well while being big winners when the new bull cycle resumed in early 2009.

While being provided a much smaller allocation, telemedicine companies made the cut as the government is aiming to reach rural residents that may not otherwise have access to medical professionals.

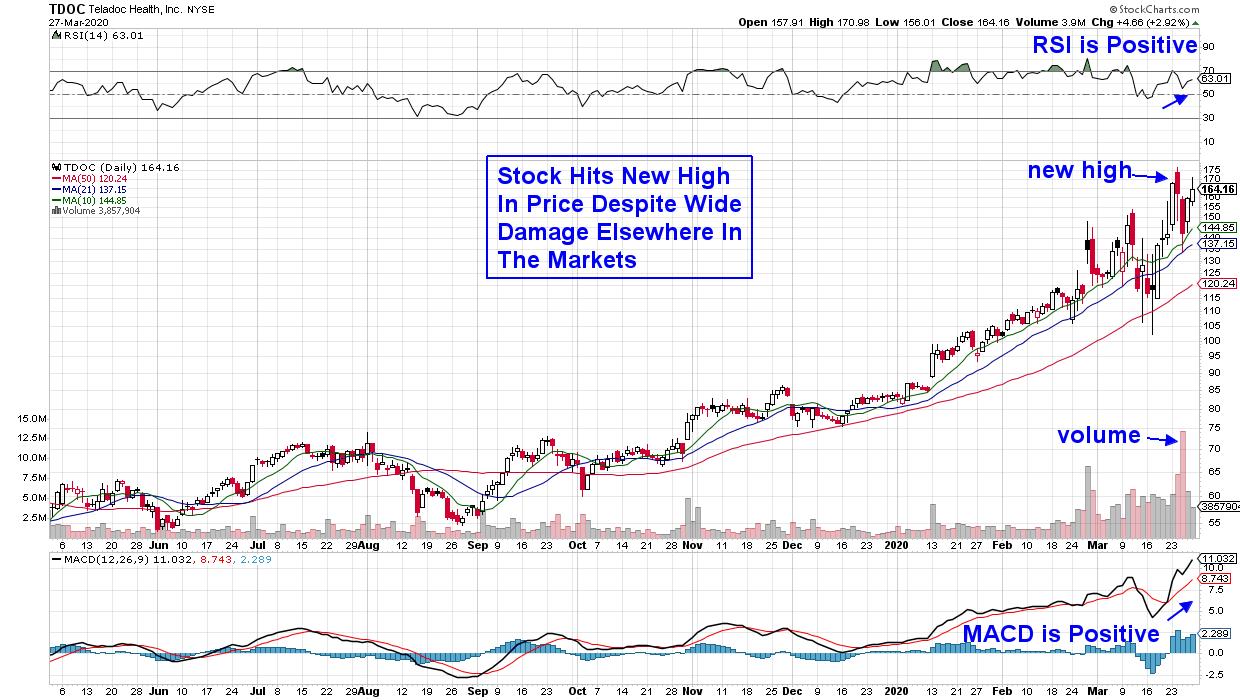

DAILY CHART OF TELEDOC HEALTH INC. (TDOC)

Telemedicine has been around for years; however, these companies now have genuine potential, with demand for their video consultations rising dramatically as quarantined populations are seeking medical advice. Teledoc Health (TDOC) is one of the more established virtual healthcare providers, as they've secured contracts with most major hospitals and insurance health plan providers since their inception almost 20 years ago.

The stock has held in remarkably well during a punishing environment for most listed companies, with TDOC hitting a new high in price earlier this week. While the stock is bullishly positioned above each of its key simple moving averages with a positive RSI and MACD, investors should be aware that it has been experiencing daily volatility that includes price swings as high as 10% on a given day.

While both stocks highlighted above have attractive charts, broader market dynamics may well dampen their potential progress over the near-term. While we've experienced a substantial rally this week, volatility levels remain high and certain longer-term bullish signals have not yet emerged.

If you'd like to be alerted to when it's safe to get back into the markets for a longer period, I urge you to take a 4-week trial of my bi-weekly MEM Edge Report for a nominal fee. My work uses a proven system that has identified every bear market reversal - and you'll be immediately alerted once we get there.

In addition, I'll be starting a daily live trading room next week. Access will be at no cost and it will last for one hour. For those interested in more information, you can go to the Contact Us tab on my website and provide your email address.

I hope you'll join with like-minded investors as we navigate these tricky markets!

Warmly,

Mary Ellen McGonagle,