It's very true at the moment that this is a "stock pickers" market, meaning it really makes a big difference which individual stocks you are trading unless you focus more on ETFs. For example, as you can see below, one of the stocks in our "Model" Portfolio, Zoom (ZM) and one in our "Strong Accumulation/Distribution" (A/D) portfolio, Peloton (PTON), have had stunning results since being added on August 19.

In the case of ZM, it has climbed by over 76%, and in the case of PTON, a rise of over 56% compared to the S&P trading flat over the same period of time. These stocks, in turn, have helped to power the Model and A/D portfolios higher, as you can see below.

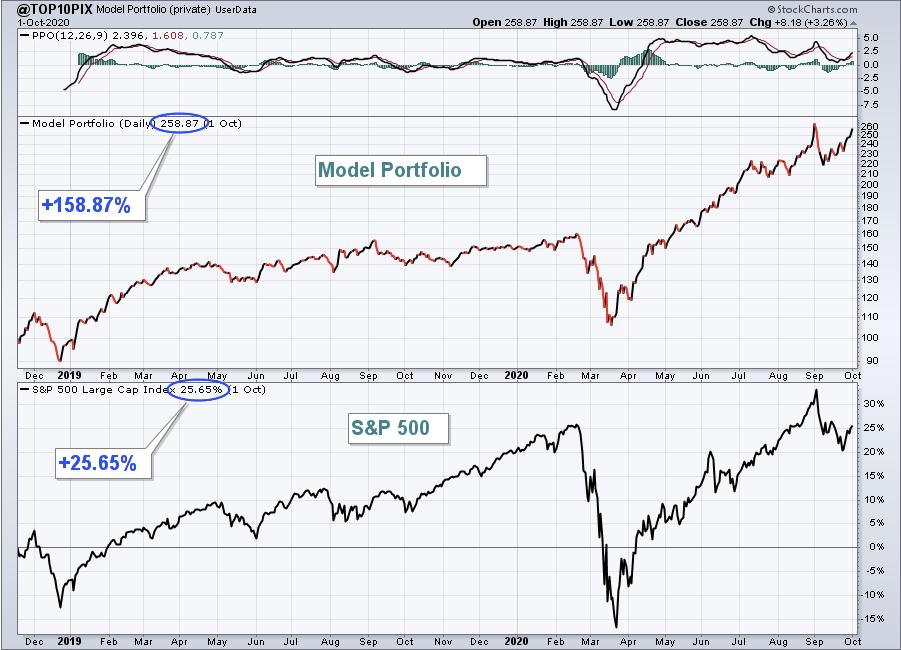

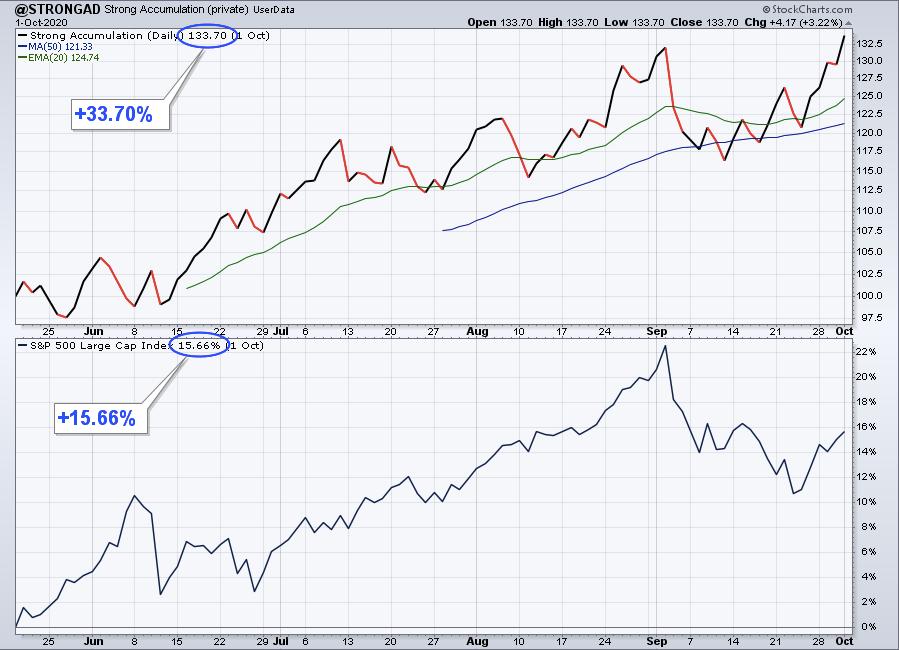

In the case of the Model portfolio, which was first established in November 2018, it has beaten the S&P by a wide margin - up over 158% through last Thursday compared to 25.6% for the S&P since its inception - and for this current quarter, it has risen by 13.9% compared to a flat S&P. The Accumulation/Distribution portfolio (first established in May of this year) has risen 33.7% compared to the S&P of 15.6% during the same period of time. That performance has been helped with some other solid winners in the portfolio, like FSLY and NIO, which has resulted in a return in the A/D portfolio for the current quarter of 12% compared to a flat S&P. Not too shabby!

As usual, not every stock in the Model or A/D portfolios has performed so well since they were added. But if you have a few powerhouses like ZM, PTON, FSLY and NIO in your trading corner, they can dramatically offset those that are lagging.

The process of finding those gems that make it into our portfolios includes scanning and narrowing the list down to a chosen few. They are then tracked using User-Defined Indexes. In fact, our Chief Market Strategist Tom Bowley will be conducting a Webinar this Saturday, October 3 at 11am ET, where he will demonstrate the basics of setting up a User-Defined Index on StockCharts.com. Tom will also demonstrate how our Model Portfolio was established and tracked using this UDI feature. Also, during the event Tom will reveal all 10 stocks in the Model and A/D portfolios - 20 in all - so you can see first hand which stocks are included. If you want to join Tom for this FREE event, just click on this link to get access to the Zoom link. And if you want to be reminded of the event in the morning, you can sign up for our free EarningsBeats Digest, which you will find immensely useful on the same page. Hope to see you there!

At your service,

John Hopkins

EarningsBeats.com