This week's 3.2% decline in the S&P 500 has this Index closing at a very important area of support, as investor confidence has been shaken amid discouraging Fed comments and weak economic data. Throw in a mixed start to earnings season with cautious outlooks from mega-cap companies, and you can understand why the markets are on edge.

Despite an overall heaviness, there were areas of solid outperformance last week among select stocks that will continue to trade higher, especially once market pressures lift.

You see, these are established companies that are providing cutting-edge, needed products for the testing, treatment or vaccination against the COVID-19 virus. Strong demand for their products will remain regardless of a potentially slower-than-anticipated economic recovery.

First up is Abbott Labs (ABT), which reported 4th quarter results last week that were well ahead of estimates. While the company is seeing growth in several areas, it was a boom in COVID-19 testing that pushed sales up 29% over last year for the company.

DAILY CHART OF ABBOTT LABORATORIES (ABT)

ABT posted stellar Q4 results; however, it was management's bullish guidance for sales this year that has investors excited. FDA authorization for at-home use of their tests is expected to keep testing sales high, while the company's diabetes care system will also spur growth.

Abbot's stock gapped up on heavy volume following their earnings release in a move that bullishly pushed the stock out of a 3-month base. With the RSI currently in an overbought position, we'd be a buyer on any pullback to the $118 range.

Next up is West Pharmaceutical (WST), which is a 100-year-old company that makes components for injectable drug devices that have been critical in the treatment of and vaccination against COVID-19.

DAILY CHART OF WEST PHARMACEUTICALS (WST)

The stock is poised to break out of a 1-month base ahead of the release of 4th quarter earnings early next month. And with new Medical companies unveiling positive late-stage test results for a vaccine, demand for their products is expected to remain high well into 2021.

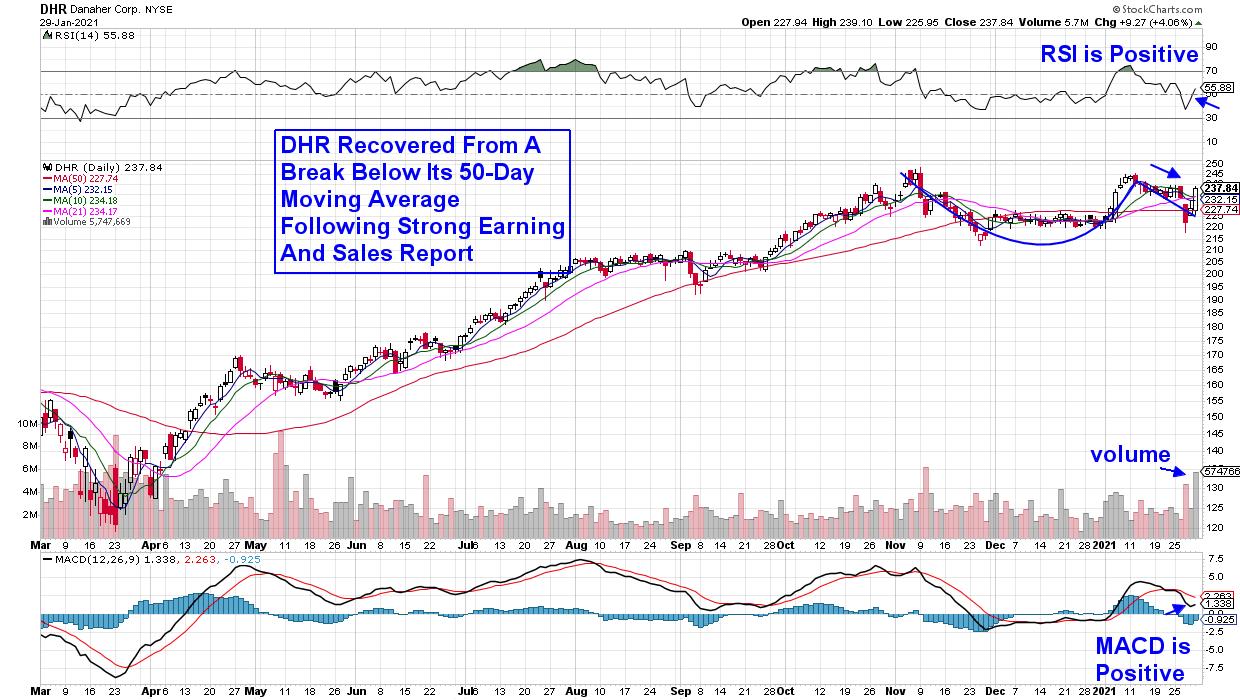

Danaher (DHR) is another established company that's seeing strong growth due to virus-related vaccines and therapies. The company reported 63% year-over-year earnings growth last week, led by their diagnostics and life sciences divisions.

DAILY CHART OF DANAHER CORP. (DHR)

The good news is the company is expecting growth to continue higher, spurred by recent acquisitions that will provide recurring revenues due to their product mix. This is on the heels of strong sales for their 4-in-1 COVID-19 and flu test.

DHR broke back above its 50-day moving average on heavy volume following its report, and the stock is poised for a cup-with-handle breakout, with a move above $245 being even more bullish.

Among the stocks mentioned above, I'm very excited about the prospects for West Pharmaceutical (WST), as the stock was a big winner for MEM Edge Report subscribers when we added it to our Suggested Holdings List last April. WST went on to gain 86% before we removed it as a buy idea after a break below key support in October. If you'd like to be alerted to winning stocks similar to WST and many others, take a 4-week trial of my bi-weekly MEM Edge Report at a nominal fee.

In addition to expert stock selection, you'll be immediately alerted when our indicators trigger a bearish sell signal for the markets. Use this link here for immediate access to our most recent report! You can also use that link to view a sample report.

In this Friday's edition of The MEM Edge, I review the broader markets as well as underlying sectors to reveal where the weakness is and what to be on the lookout for going forward. I also present defensive stocks that are poised to trade higher, as well as names that are ignoring the markets and charging to new highs.

Warmly,

Mary Ellen McGonagle. MEM Investment Research