With the SPY/SPX chart sending curveballs, sector rotation on Relative Rotation Graphs is sending conflicting signals. With breadth continuing to deteriorate as the S&P continues to creep higher, getting a handle on the markets is not getting any easier. So instead of focusing on the S&P/US market, I started to look at how things are going in the rest of the world.

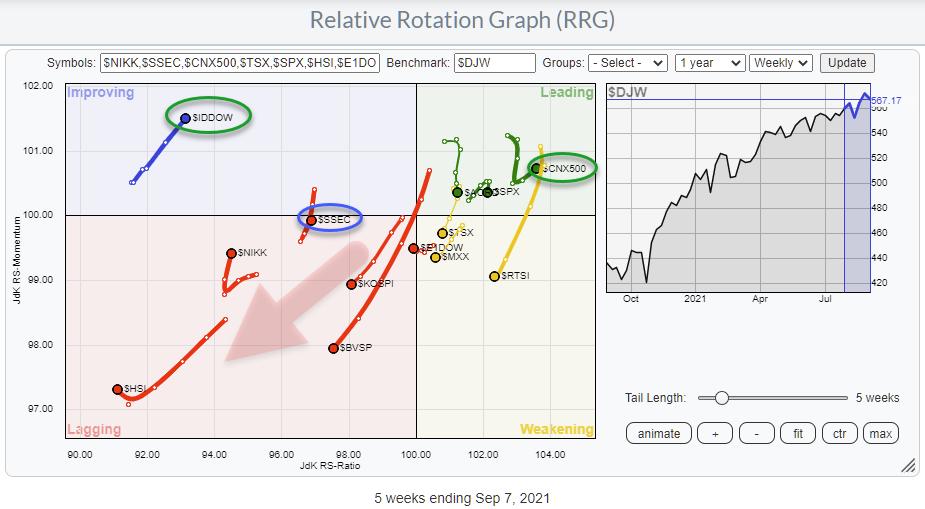

The starting point is the RRG, printed above, which shows the rotation for a group of major stock market indexes around the world against the DJ Global index as the benchmark. The first observation on this chart is that the dominant RRG heading is negative, i.e. between 180-270 degrees. Also, there are only three indexes inside the leading quadrant, and only one of them (India) is traveling at a positive RRG-Heading.

The S&P/US is inside the leading quadrant, but has very recently also started to roll over. This means that, so far, the US was/is still in a relative uptrend vs. most parts of the world, but is now also losing strength.

I shared the chart for the DJ Global Index in my DITC article "Pressure Continues to Build for Global Markets" yesterday. The divergence and the loss/fading of upward momentum is clearly visible on that chart. Some of the indexes on the RRG above are showing very similar charts.

The indexes for Brazil, Mexico, and Korea are showing the strongest examples of pressure mounting and weakness underway.

The index for Indonesia, $IDDOW, is currently inside the improving quadrant and at a strong heading. However, it is still far to the left with a very low reading on the RS-Ratio scale. This makes it difficult to maintain that momentum and travel all the way towards and into the leading quadrant. There is a very good chance that this tail will roll over while inside the improving quadrant and rotate back towards the lagging quadrant.

As you can see on the chart above, $IDDOW has not been able to take out former highs, which date back to 2018. A quick look at the raw RS-Line vs. $DJW confirms that the relative downtrend is still in full force.

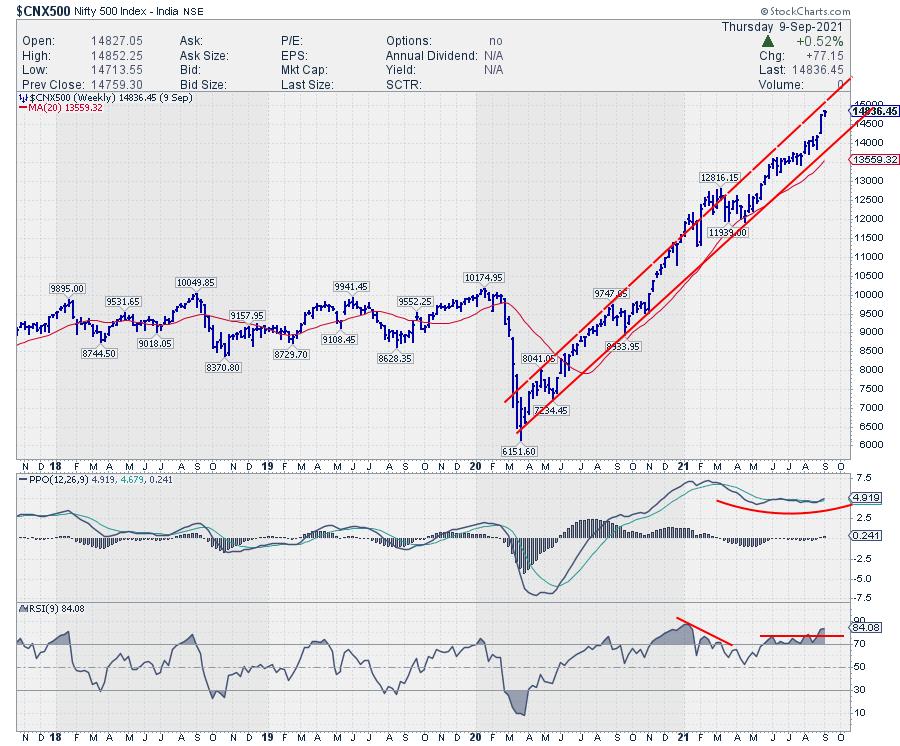

Pretty much the only index that seems to be able to abstract itself from all this weakness at the moment is the Indian Nifty 500 index. It is positioned inside the leading quadrant and recently hooked sharply back up to travel further into the leading quadrant at a strong heading.

The negative divergences that were also present in this market seem to be resolving without any meaningful correction as the Nifty continues to climb higher within the boundaries of its rising channel.

Just to be clear, it is possible that such a scenario will be playing out for the S&P 500, but, given all the observations as described above, I don't see that as the primary scenario at the moment.

#StaySafe and have a great weekend, --Julius

My regular blog is the RRG Charts blog. If you would like to receive a notification when a new article is published there, "Subscribe" with your email address.

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Research

Host of: Sector Spotlight

Please find my handles for social media channels under the Bio below.

Feedback, comments or questions are welcome at Juliusdk@stockcharts.com. I cannot promise to respond to each and every message, but I will certainly read them and, where reasonably possible, use the feedback and comments or answer questions.

To discuss RRG with me on S.C.A.N., tag me using the handle Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.