TAKEAWAYS

- You want to invest in stocks and ETFs in the best-performing sector

- Within the best performing sector, find the top sub industry

- Identify stocks and ETFs with promising charts and find an opportune entry point

When broad equity indexes move higher and higher and you don't actively add stocks or ETFs to your portfolio, it's natural for you to think that you may have missed the ride, as some of the stocks you really wanted may now be priced too high. This may tempt you to look for cheaper stocks, which can get tricky. There's nothing wrong with buying cheap stocks; you just need to adopt a smart approach.

In How to Trade In Stocks, one important point Jesse Livermore mentions is that, when you select securities to trade, you should "stay with the powerful healthy Industry Groups." This is very helpful advice, but how do you find bargain stocks within healthy industry groups? The best way—perform a top down analysis.

Start With the Leading Sectors

Each day presents a different story, so, when looking at the bigger picture, it's best to look at a longer-term time frame when identifying the strong sectors. Let's examine a hypothetical situation, although it's not far removed from what the stock market is going through in the second half of 2023.

Looking at the StockCharts Sector Summary tool, you can see that, in the last three months, the Technology sector was the clear leader. The three-month daily chart of the Technology Select Sector SPDR Fund (XLK) below shows that the ETF started outperforming the S&P 500 index ($SPX) in April 2023.

CHART 1: TECHNOLOGY SELECT SECTOR SPDR FUND (XLK). The Technology sector was the top-performing sector in the last three months, which is reflected in the chart of XLK.Chart source: StockCharts.com (click chart for live version). For educational purposes.

XLK has traded above its 20-day simple moving average (SMA) since early May. The ETF bounced off the 20-day SMA a couple of times. As long as XLK continues rising, stocks within this sector should continue to perform well. But that doesn't necessarily mean every stock within the sector will perform well.

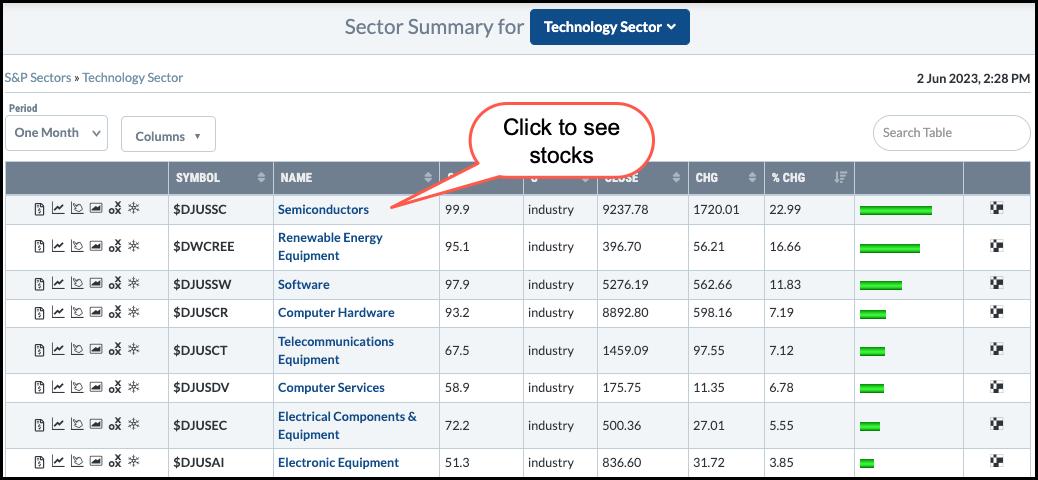

Again, the Sector Summary tool can help you narrow your stock search. Click on Technology Sector Fund in the name column. This will display:

CHART 2: SEMICONDUCTORS ARE THE LEADING SUBINDUSTRY. If you click on "Semiconductors" you'll see a list of stocks that make up this sub-industry.Chart source: StockCharts.com. For educational purposes.

How To Use the Sector Summary Tool

How To Use the Sector Summary Tool

- From Your Dashboard or Charts & Tools, under Summary Pages, click on Sector Summary.

- Select time period for analysis from the Period dropdown menu (in this case, Three Month).

- Click on the name of the ETF. This displays a summary for the selected sector.

- Click on the leading industry name, which in this case is Semiconductors.

- Sort the stocks in the Semiconductor industry by any column. If you sort based on SCTR Universe (U), with large caps listed first, you can scroll down the list of stocks.

Zeroing In on Stocks or ETFs

Say NVIDIA Corp. (NVDA) is on top of the list. But its price may be a bit rich. So you look at the next stock, Marvell Technology Inc. (MRVL). The stock price is more attractive, but, when you hover your mouse over the stock symbol and view the thumbnail chart of MRVL, you may find it doesn't meet your criteria. So you move on to the next one. This is a quick way to look through the charts on the list and do a first pass.

The next hurdle is to figure out which stocks to trade. This is when you put on your analyst hat and dive deeper into the promising charts. Click on the company name or select an option from the menu on the left. If a chart looks interesting, add your favorite technical indicators and overlays and analyze away. This will narrow your focus to a few stocks, which you can add to one of your ChartLists.

One of the charts that appealed to you is ON Semiconductor Corp. (ON). The daily chart shows the stock is trending higher (see below). Its Relative Strength Index (RSI) is below 70, and relative strength against the S&P 500 index ($SPX) is weakening. Overall, the stock is showing strength, but it looks like it may be pulling back.

CHART 3: IS ON SEMICONDUCTOR READY FOR A PULLBACK? A pullback will present a buying opportunity if the stock continues its uptrend after a pullback. The first support level would be the $100 level, which was an area where the stock paused a few days ago. If the stock fell lower, it could reach the 25-day moving average.Chart source: StockCharts.com (click chart for live version). For educational purposes.

How much lower could ON stock go before it turns around and continues its uptrend? If you look back at the chart, price has bounced off its 25-day SMA during the last significant pullbacks. If the stock pulls back to the 25-day SMA, it could present a buying opportunity. But the stock is a ways away from the 25-day MA. Before that, the stock may find support at the $100 level, since there was a pause with relatively wide-ranging price bars. If the stock pulls back to around $100, look for signs of a bounce back up on strong volume. If it doesn't reverse there, then look for the stock to go lower, toward its 25-day SMA.

Keep an eye on the RSI as well. If RSI remains between 50 and 70 during the pullback, there's a chance the stock could reverse and move back up.

It also helps to add an indicator that looks at the buying or selling pressure, such as the Accumulation/Distribution Line (ADL). In the daily chart of ON above, the ADL is overlaid on the price chart (pink line). During the upward move from May, the ADL showed strong buying pressure. As long as the buying pressure continues to dominate, the probability of an uptrend is high. In short, there's a good chance the stock may move even higher.

The Bottom Line

ON Semiconductor reached its all-time highs on Tuesday, so there's no upper resistance level. Keep an eye on support levels during a pullback. If there's enough momentum to push the stock higher, this could be a worthwhile stock to add to your portfolio.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

Happy charting!