One of the frustrations investors have is looking through the charts of common stocks and never seeing the great growth stocks that are accelerating.

How can we find these stocks?

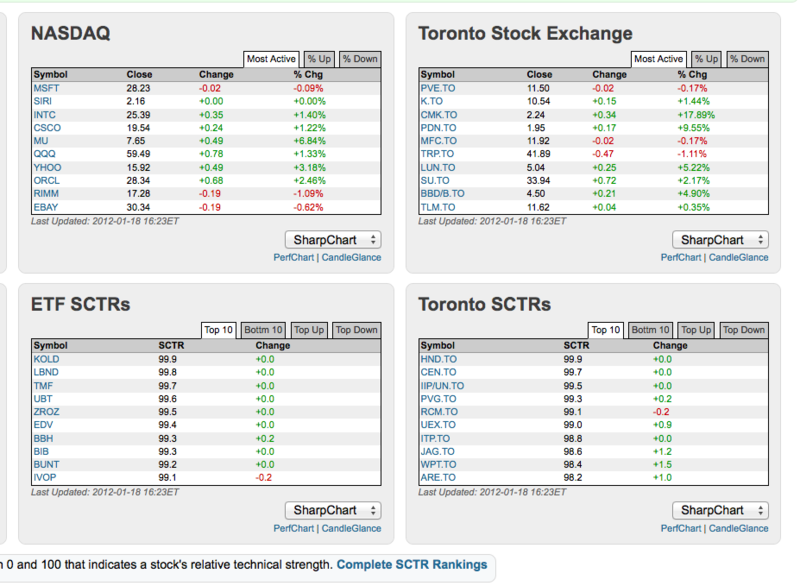

Well the SCTR ranking system is extremely valuable. It will show you the powerful stocks and then you can choose those stocks to propel your portfolio. Why is this so important? Doesn't the market just move together?

Well if you are a hedge fund manager, you are measured against an index. If you don't outperform the index, you need to find a new job. So the hedge fund managers are looking for large, liquid stocks that can really accelerate faster than the overall market.

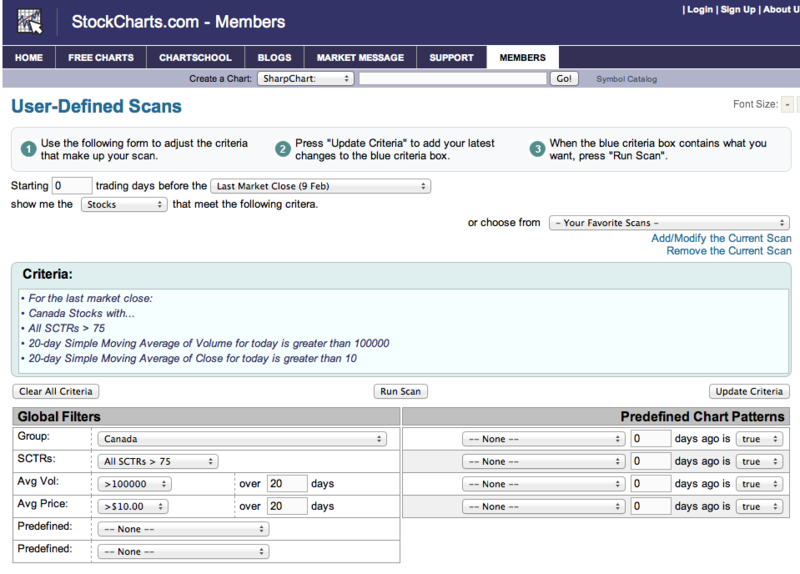

So you need stocks with larger liquidity. What does that mean? If you take the price of the shares x the avg daily volume. So let's pick 100,000 shares minimum/day x $10. That is a $1 million / day liquidity. Sometimes a major stock like RIMM will have massive liquidity. You can also see if the stock is listed on a US exchange. IF so, this liquidity will help push up the price in Canada as some market maker will manage the arbitrage between the Canadian and US market.

In the US you can use larger liquidity minimums becuase of the size of the markets. But in Canada we have smaller liquidity. However, as an individual investor, we need to target liquidity. We want to find the companies that are growing, that the hedge funds are buying, to help push up the prices. It also helps if the sector is very powerful. So we need relative liquidity, a strong sector, and a bullish market.

To run a scan on the SCTR rankings, Set up the scan page like this. Make your adjustments accordingly. Try to focus on liquidity so the investment funds can help your stock. A $1 Million/day liquidity is large, but keep massaging the filter till you get a good strong feel for liquidity.

Then you will get a new tab that you must look in to find the list of stocks. From there, choose a chartlist to put the stocks in and work with. Again, adjust your liquidity, either higher price or higher volume, to something stronger.

This list has 45 stocks for you to work with. Now you have a list of strong stocks. If you can find all the strong stocks are in a particular sector, that is very bullish. What you'll find is stocks with charts that go from bottom left to top right. Kinda nice! After that you can click on the dropdown box and select candleglance. This allows you to get a quick look at all the stocks.

The SCTR system is new. Be among the first to profit with it.

Good Trading,

Greg Schnell, CMT.