Editor's Note: This article was originally posted in Technical Analysis of Stock Trends on Wednesday, September 12th at 11:17pm ET.

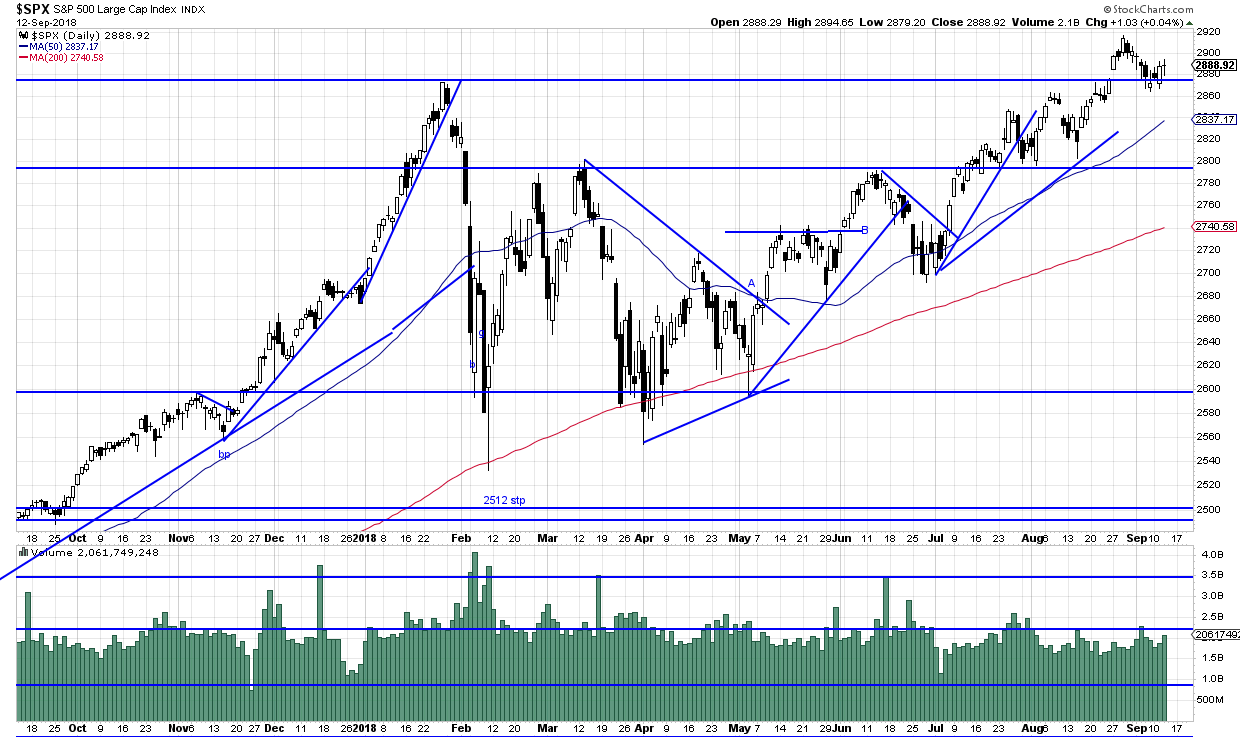

Traders sell strength and buy weakness. This includes for some the short of a gap -- even when that gap is a jump out of congestion on volume. We regard this as a species of Russian roulette. There is in fact a sometime prominent trader who advocates just that technique. This can be effective for scalping -- as we see in the present example. Breakaway gap then price erosion and you could have made a profit. Of course you run into a buzzsaw if a runaway gap follows the breakaway. The tactic is too short term and nervous for us. We have known technicians who waited for the pull back from the gap before initiating a position.

We regard this formation as just such an example -- gap, pull back, resumption of basic trend.

W.H.C. Bassetti

Edwards-Magee.com

Click here for more information on subscribing to the Edwards & Magee newsletter.