-- Financial stocks showing relative weakness

-- Stocks trading near resistance and overbought

-- Bullish considerations

After a big advance the last 9-10 weeks, many stocks are running into resistance. In addition, many are are overbought and ripe for at least a correction or consolidation. The same can be said for many indices and ETFs. The next group of charts highlights stocks trading near resistance after sharp advances.

FedEx (FDX) is hitting resistance from broken supports and the 50% retracement. Also notice that the stock is up over 50% without a correction and the Commodity Channel Index (CCI) has been overbought for most of the last five weeks. Even though the trend since early March is up, the stock looks awfully vulnerable to a correction.

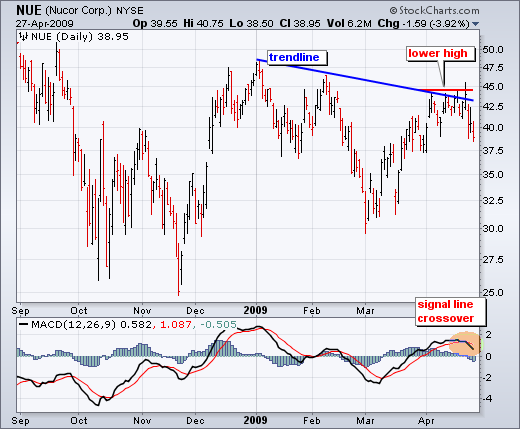

Nucor (NUE) surged to trendline resistance in early April and then stalled. Selling pressure got the better part of the stock as it declined rather sharply the last three days. With resistance established below the February high, a lower high is now taking shape. The bottom indicator shows MACD moving below its signal line as momentum deteriorates.

Tidewater (TDW) is hitting resistance from the top of its recent trading range. The stock has been bouncing between the low 30s and the mid 40s since October. After a 40% surge over the last two months, the stock is overbought and at resistance. Notice that the Stochastic Oscillator is trading above 80.

CH Robinson (CHRW) is nearing range resistance after surging over 30% in less than two months. The stock established support around 37-38 with two big bounces in October and March. Resistance around 56 stems from the September-January highs. CHRW gapped higher last week, but further upside looks limited with resistance close at hand. Also notice that the Stochastic Oscillator is overbought as it trades above 80.