Over the last ten years, there is generally a positive correlation between long-term interest rates and the Dow Industrials. The 10-Year Treasury Yield ($TNX) and the Dow fell from 2000 to 2003, rose from 2003 to 2007, fell from 2007 to 2008 and rose in 2009. Falling interest rates were traditionally considered bullish for stocks, but that is clearly not the case over the last 10 years. Long-term rates fall when economic conditions deteriorate or when there is a financial crisis. Or both. Long-term rates rise when economic conditions and the financial system strengthen.

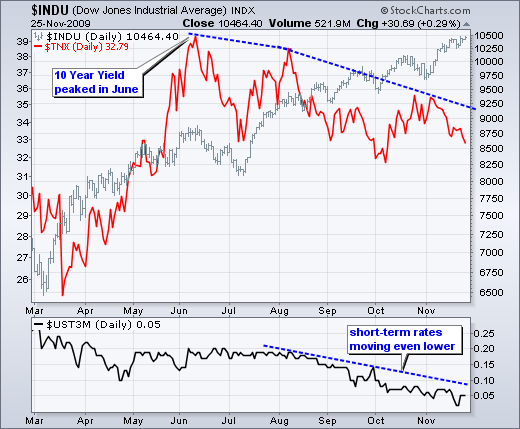

The 10-Year Treasury Yield bottomed in December 2008 and stocks bottomed in March 2009, 2-3 months later. While the Dow moved to new highs in November, the 10-Year Treasury Yield remains well below its June peak. Long-term rates peaked some five months ago. Even though long-term rates are well above their December-March levels, a downtrend in rates does not bode well for stocks because it suggest fragility in the economic recovery and/or financial system. Also notice that short-term rates declined to their November 2008 lows, which were near zero percent. This is also a vote of non-confidence. The bulk of the evidence remains bullish for stocks, but I am quite concerned by low short-term rates, falling long-term rates and relative weakness in the finance sector.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More