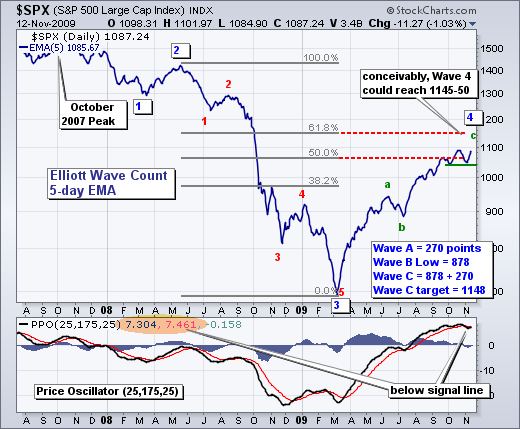

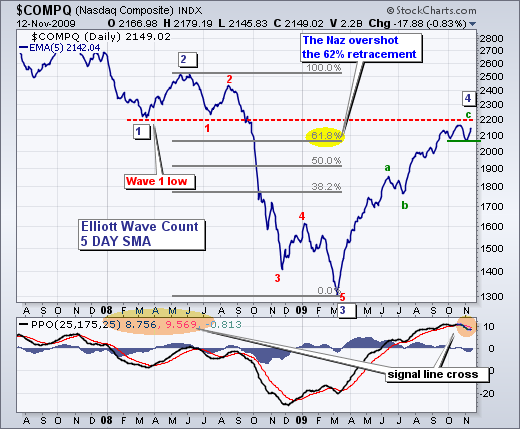

Nothing has changed regarding my interpretation of the Elliott Wave counts for the Nasdaq and S&P 500. Both indices are in Wave 4 advances or a 5 Wave decline. The Wave 4 target zone for the S&P 500 is 1080-1150, while the target zone for the Nasdaq is 2100-2200. A move above 2200 in the Nasdaq would call for a re-count of the Wave structure. With both indices trading in their target zones, upside could be limited over the next few weeks.

I am not ready to call for the start of Wave 5 because the bulk of the medium-term evidence remains bullish. Sure, there are some warning signs about, but Wave 5 cannot start until the uptrend in Wave 4 actually reverses. The green lines mark support from the October-November lows. Look for both to break these levels to reverse the Wave 4 uptrend and signal the start of Wave 5. While a pretty substantial decline would be expected in Wave 5, don't forget that fifth waves can sometimes be truncated and stop short of the Wave 3 lows.