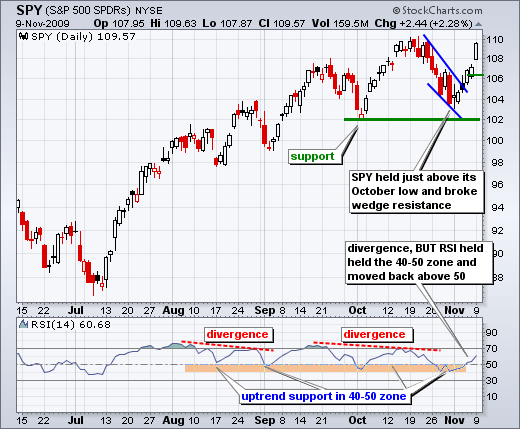

With a gap and big advance on Monday, the S&P 500 ETF (SPY) is already challenging resistance from its October highs. I would not consider this major resistance, but rather potential resistance because the medium-term and short-term trends are up. Support levels are important in uptrends because they define the uptrend. After all, it takes a support break to reverse an uptrend. Resistance levels are only potential stopping points because the bulls control an uptrend.

Since the July surge, SPY has been stair stepping higher up with a series of higher highs and higher lows. A higher high is the next logical step. Moreover, the Dow already broke above its October high. It is important that Monday's gap and surge hold. A move back below 106.5 would fill the gap, which would then question underlying strength. Let's cross that bridge if and when it gets here.

On the 30-minute chart, SPY kick started an uptrend with the resistance breakout at 105.5 on Wednesday, November 4th. CCI also moved above +100. Notice how CCI is hovering around +100. This level is normally associated with overbought conditions, but it is really a show of strength. Upside momentum is strong around +100. Downside momentum is strong around -100. Monday's gap stands out on this chart and I am marking key support at 106.5. A move below this level and a CCI break below -100 would reverse the short-term uptrend.