Breadth and volume are the first ports of call after a big move. Before going any further, I must emphasize that breadth and volume are indicators. I view breadth as an important indicator, more important than volume. However, as indicators, both breadth and volume are still secondary to price action, which is the ultimate arbiter. Trading profits and losses are not affected by breadth and volume.

Monday definitely qualifies as a big move. All major indices were up 2% or more. All sectors were up with five of nine advancing over 2%. The laggards (up less than 2%) were healthcare, energy, consumer staples and utilities, which are the defensive sectors. Despite a big day all around, Nasdaq and NYSE volume levels were well below average.

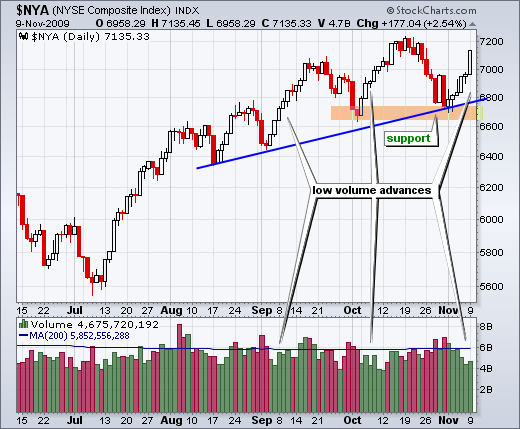

NYSE volume was below average the last three days. The NY Composite is up 4.46% in three days, but volume was not even average. Actually, the advances in early September and early October featured low volume as well. This is a potential warning sign, but it is not sufficient to turn bearish right now.

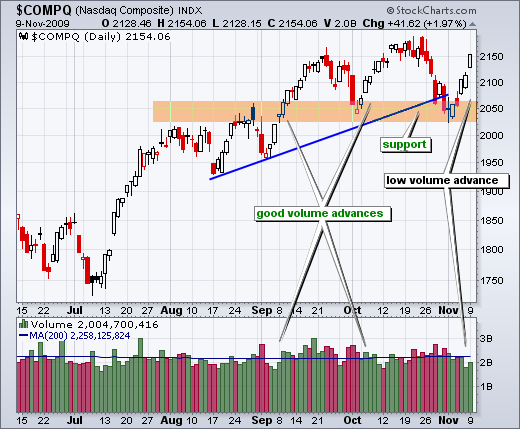

Nasdaq volume was fairly strong during the early September and early October advances, but was not strong over the last three days. Thursday's volume was average while volume on Friday and Monday was below average.

The next two charts show Net Advances and Net Advancing Volume for the Nasdaq and NYSE. Net Advances equals advancing stocks less declining stocks. Net Advancing Volume equals volume of advancing stocks less volume of declining stocks. I am comparing breadth on Thursday's big advance with breadth on Monday's big advance. Did participation narrow or broaden from Thursday to Monday? Nasdaq breadth was weaker on Monday than Thursday. This is not a good sign because it shows less participation.

In contrast to Nasdaq breadth, NYSE breadth was stronger on Monday. Net Advances and Net Advancing Volume were both higher. This shows expanded participation in NYSE stocks, which is bullish. Look no further than the finance sector, which led all sectors on Monday. With Nasdaq breadth weaker and NYSE breadth stronger, the overall picture for breadth is mixed.