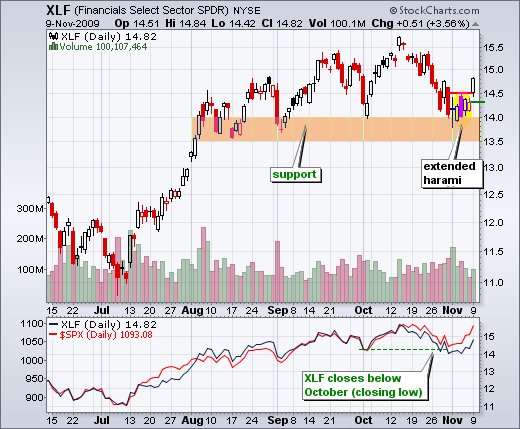

The Financials SPDR (XLF) confirmed last week's harami with a gap breakout. XLF hit support in late October and formed a big spinning top on November 2nd. With the short-term trend down, the stock formed a long red candlestick on Wednesday and two inside days on Thursday-Friday. The high-low range for both Thursday and Friday was contained within Wednesday's high-low range.

Basically, a harami formed on Wednesday-Thursday and this pattern extended into Friday. With Monday's gap and range break, the harami is confirmed and support is affirmed. As with SPY, this breakout is only valid as long as it holds. Therefore, I am watching gap support and a move below 14.3 would call for a reassessment.

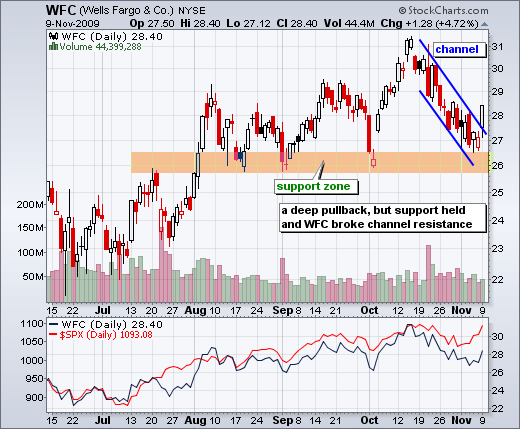

Wells Fargo (WFC) declined all the way to the top of its support zone, but ultimately held and broke channel resistance with a surge on Monday. Even though the depth of this pullback is disconcerting, WFC did forge a higher high in mid October and held above its prior low. Technically, the trend remains up and this channel breakout is bullish until proven otherwise.