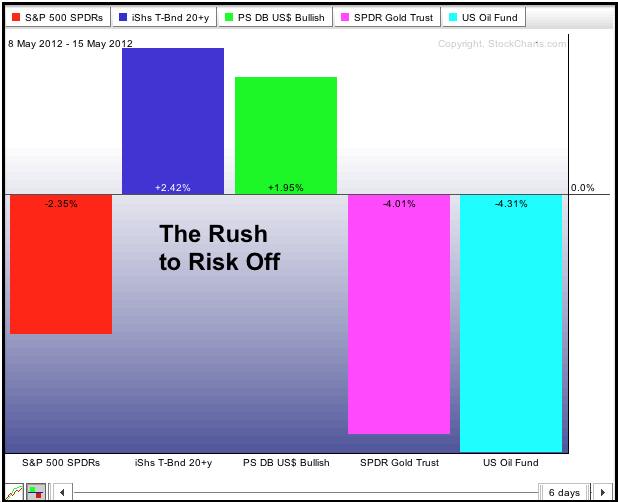

US stocks opened strong on Tuesday, but buyers lost their nerve again and the major index ETFs closed near their lows for the day. Treasuries continued higher as investors sought relatively safety ahead of June elections in Greece. Needless to say, the Dollar soared and the Euro plunged. Commodities plunged with oil and gold dropping over 1%. These all-or-nothing markets are clearly all-in for the risk-off trade. European uncertainly will hang over the markets until at least the 17-June elections, and likely even further.

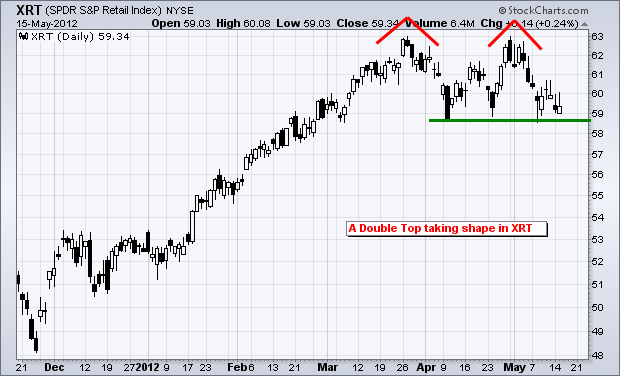

In the US, the Empire State general conditions index surprised to the upside, but Retail Sales were weaker than expected. In fact, retail sales barely grew in April and the March numbers were revised down. This shortfall was also reflected in Home Depot, which missed on its sales projections. I think the shortfall in retail sales is worrisome because retail drives some 2/3 of GDP and the Retail SPDR (XRT) has been one of the strongest groups. A breakdown in XRT would negatively affect the Consumer Discretionary SPDR (XLY).

On the 60-minute chart, the S&P 500 ETF (SPY) broke below its April lows last week, formed a rising wedge and continued lower with a gap down on Monday. The ETF tried to firm around 134-135, but fell to new lows with a close below 133.50 on Tuesday. This is a freefall that will likely end with some sort of washout or selling climax. Best guess for a spike low or a bounce? The 130 level (1300 $SPX) represents a nice round number and the 200-day SMA resides around 128 (1280 $SPX).

**************************************************************************

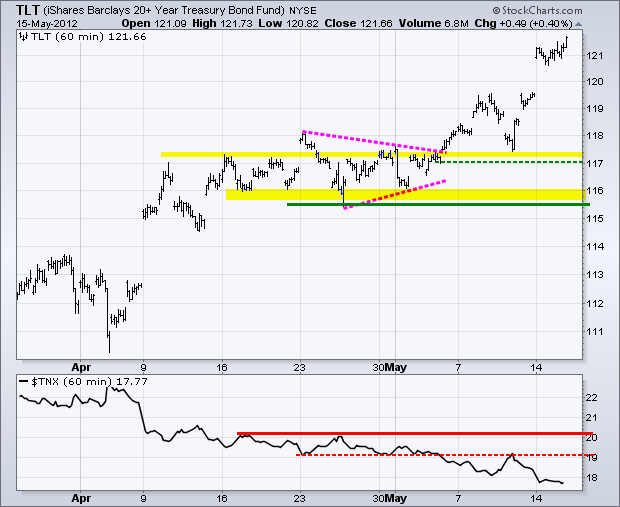

No change. The 20+ Year T-Bond ETF (TLT) surged above 120 and closed above 121 as money moved continued moving into relative safety. TLT is getting quite overbought, but remains in a strong uptrend. Broken resistance in the 117-117.5 area turns into the first support zone to watch. Key support remains at 115.5-116 for now.

**************************************************************************

The US Dollar Fund (UUP) is now up 11 days straight, which is the entire month of May. The advance started rather slow, but picked up steam on Tuesday with a .83% surge. This 11 day advance is the strongest since November 2011. More importantly, this thrust is coming off support and the ETF broke the March high. Even though UUP is short-term overbought, the strength of this surge suggests that UUP will exceed the January high.

**************************************************************************

No change. Oil is as oversold as treasuries are overbought. Moreover, note that these two are negatively correlated, as our stocks and treasuries. A pullback in treasuries would likely lead to a bounce in stocks and oil. However, like stocks, this bounce would be deemed an oversold bounce for now. The US Oil Fund (USO) broke pennant support on Monday and this pennant zone marks a resistance zone.

**************************************************************************

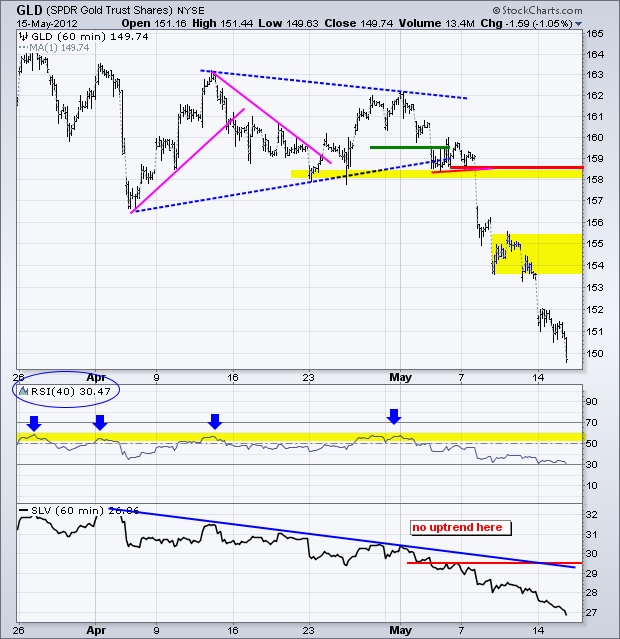

No change. The Gold SPDR (GLD) is very oversold, but just becomes more oversold, which happens in a strong downtrend. GLD is now down some 6% this month and ripe for an oversold bounce. However, GLD remains a falling knife and catching this knife is risky, to say the least. Should GLD bounce, I would mark the first resistance zone around 154-155.

**************************************************************************

Key Economic Reports:

Tue - May 15 - 10:00 - NAHB Housing Market Index

Wed - May 16 - 07:00 - MBA Mortgage

Wed - May 16 - 08:30 - Housing Starts/Building Permits

Wed - May 16 - 09:15 - Industrial Production

Wed - May 16 - 10:30 - Oil Inventories

Wed - May 16 - 14:00 - FOMC Minutes

Thu - May 17 - 08:30 – Jobless Claims

Thu - May 17 - 10:00 - Philadelphia Fed

Thu - May 17 - 10:00 - Leading Indicators

Fri - May 18 - 10:00 - TGIF

Sun - Jun 17 - 10:00 – Greek Elections

Charts of Interest: Tuesday and Thursday in separate post.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More