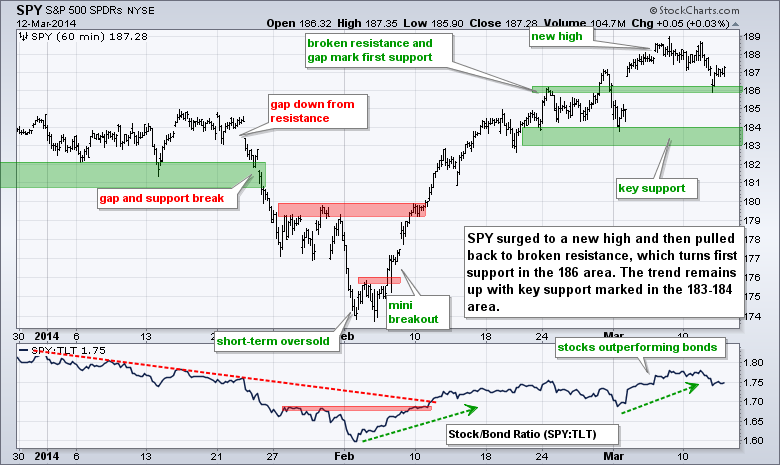

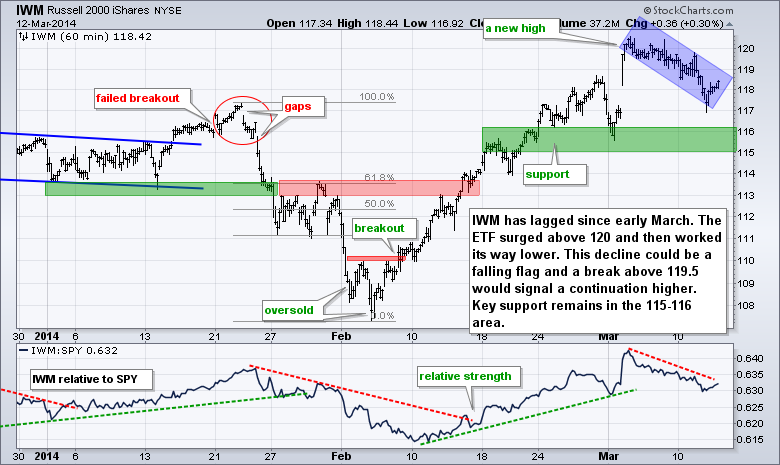

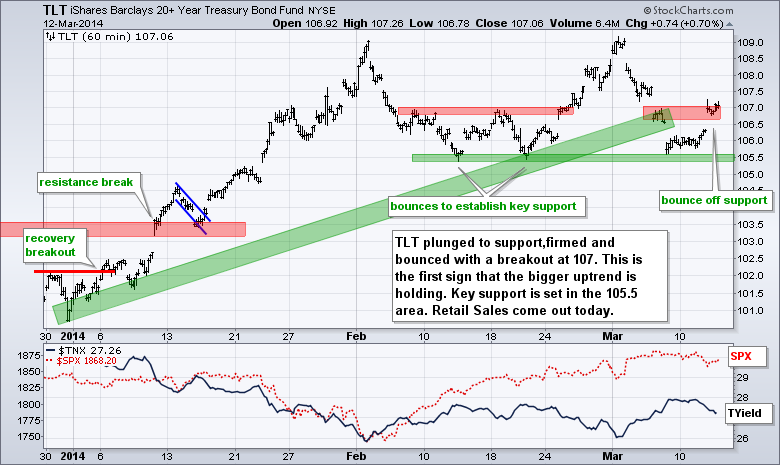

Programming note: Charts of Interest will not be posted today and return next Tuesday. Stocks were mixed on Wednesday and the major index ETFs have edged lower over the past week. The Nasdaq and NYSE AD Lines are near support zones, as is the NYSE AD Volume Line. The Nasdaq AD Volume Line remains strong with a new high. High-Low Percent fell back below 2.5%, but remains positive. This sets up the first test of the short-term uptrend, which began in early February. While support breaks in these key breadth indicators would be negative, keep in mind that the major index ETFs are in long-term uptrends and the end of the quarter is approaching, which means a dip may trigger some window dressing by under-invested fund managers. The Retail SPDR (XRT) will be in the spotlight today because Retail Sales will be reported before the open.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Thu - Mar 13 - 08:30 - Initial Jobless Claims

Thu - Mar 13 - 08:30 - Retail Sales

Thu - Mar 13 - 10:00 - Business Inventories

Thu - Mar 13 - 10:30 - Natural Gas Inventories

Fri - Mar 14 - 08:30 - Producer Price Index (PPI)

Fri - Mar 14 - 09:55 - Michigan Sentiment

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.