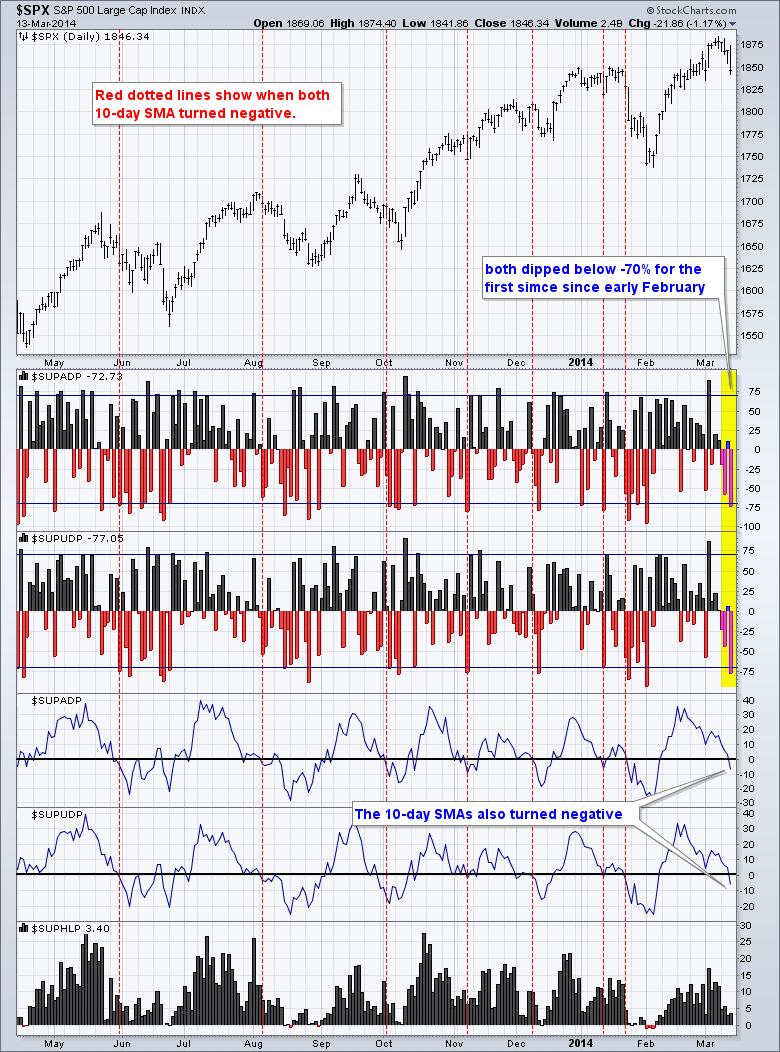

Stocks came under broad selling pressure with the Nasdaq 100 ETF (QQQ) leading the way lower. The major index ETFs fell with losses ranges from 1% to 1.5%. These losses are relatively modest. Eight of the nine sectors were down. The Utilities SPDR (XLU) bucked the trend and posted at 1.04% gain. Weakness in the Home Construction iShares (ITB) and Retail SPDR (XRT) weighed on the consumer discretionary sector. The chart below shows another way to look at breadth using indicators from the S&P 1500. The first two windows show AD Percent and AD Volume Percent. AD Percent equals advances less declines divided by total issues. AD Volume Percent equals advancing volume less declining volume divided by total volume. Notice that both dipped below -70% for the first time since early February. This reflects broad-based selling pressure. Also notice that the 10-day SMAs for these indicators moved into negative territory for the first time since early February.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Fri - Mar 14 - 08:30 - Producer Price Index (PPI)

Fri - Mar 14 - 09:55 - Michigan Sentiment

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.