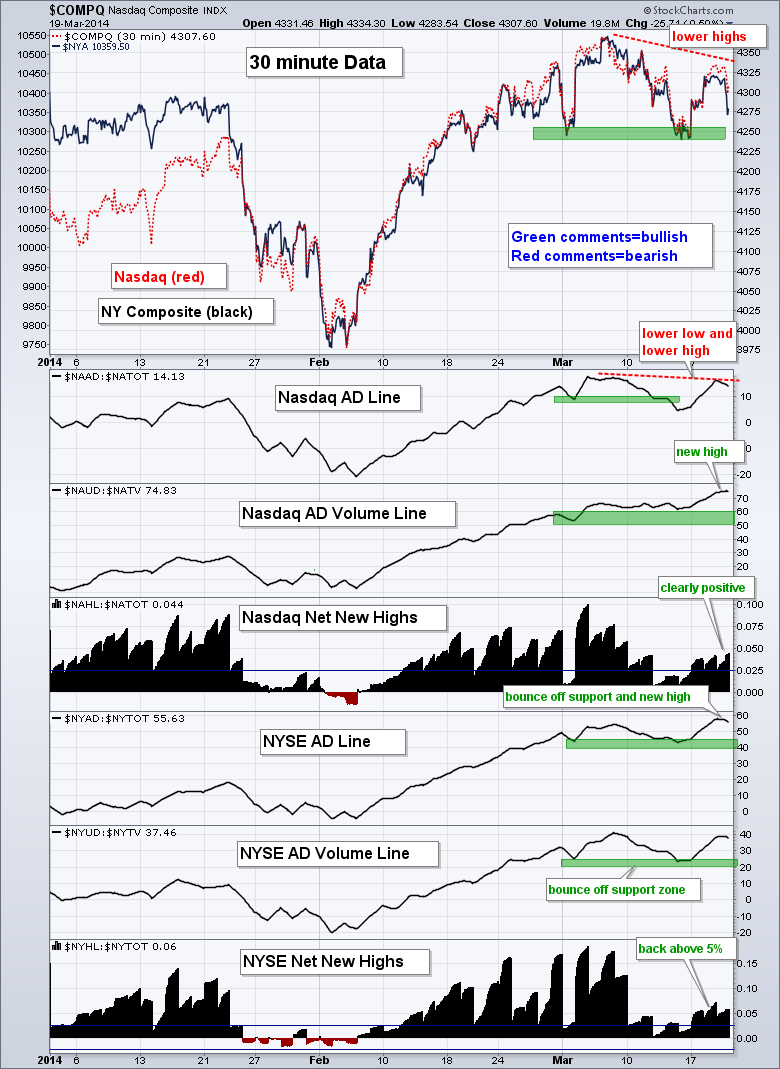

Stock market action was quite volatile around the Fed policy statement and the major index ETFs closed modestly lower by the time the dust settled. Weakness was pretty much across the board with IWM losing .57%, QQQ falling .54% and SPY declining .53%. Notice, though, that these declines are modest and not indicative of intense selling pressure. All sectors were down, but the Finance SPDR (XLF) held up the best with a .05% loss. Utilities were hit the hardest with a 1.58% loss. Elsewhere, the Regional Bank SPDR (KRE) managed a modest gain and there was strength in select tech groups. Metals-related plays were slammed with the Copper Miners ETF (COPX) falling 3.15% and the Gold Miners ETF (GDX) losing 3.75%. The intraday breadth chart below remains bullish overall, but a few red annotations have crept into the picture. The Nasdaq and NY Composite have lower highs working, as does the Nasdaq AD Line. I will be watching support zones for the Nasdaq AD Volume Line, NYSE AD Line and NYSE AD Volume Line closely over the next few days. Breaks in these three would be short-term bearish for the stock market overall.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Wed - Mar 19 - 07:00 - MBA Mortgage Index

Wed - Mar 19 - 10:30 - Crude Inventories

Wed - Mar 19 - 14:00 - FOMC Rate Decision

Thu - Mar 20 - 08:30 - Initial Claims

Thu - Mar 20 - 08:30 - Continuing Claims

Thu - Mar 20 - 10:00 - Existing Home Sales

Thu - Mar 20 - 10:00 - Philadelphia Fed

Thu - Mar 20 - 10:00 - Leading Indicators

Thu - Mar 20 - 10:30 - Natural Gas Inventories

Fri - Mar 21 - 09:00 - Happy Friday!

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.