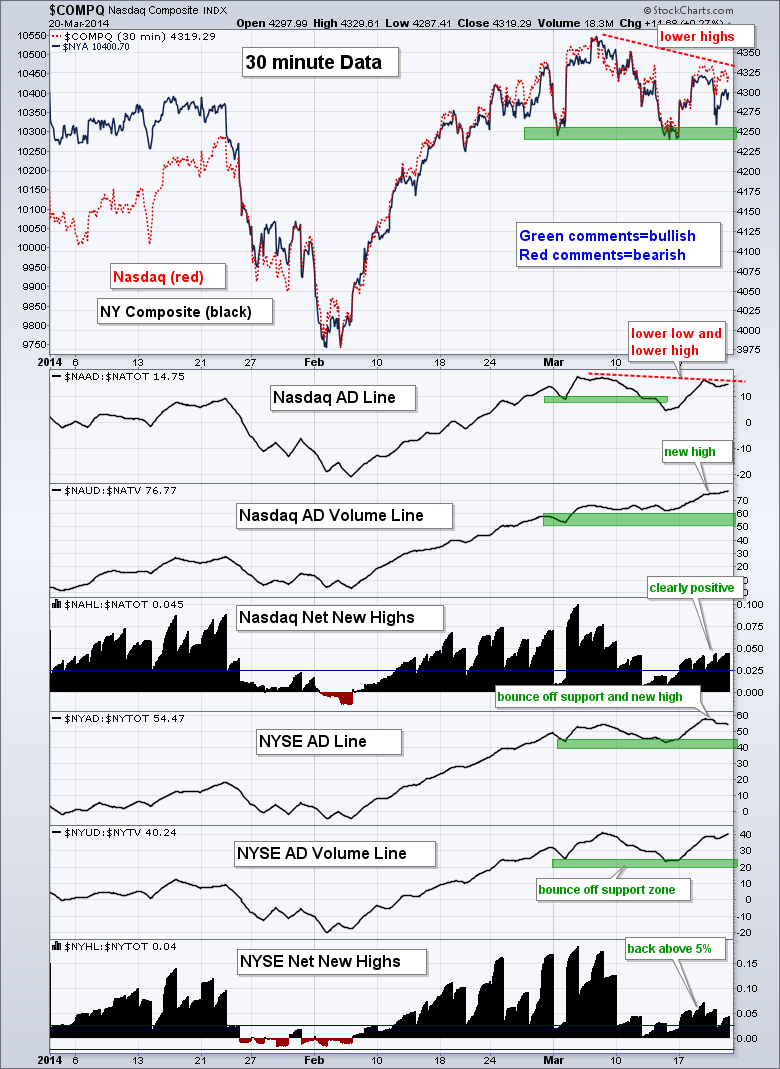

Stocks moved higher on Thursday with the finance sector leading the charge. The Finance SPDR (XLF) gained 1.58% and the Regional Bank SPDR (KRE) advanced 2.04%. The finance sector and banks clearly like what they heard from the Fed. The Home Construction iShares (ITB) fell back with a 1.64% loss though. Combined with a small decline in the Retail SPDR (XRT), the consumer discretionary sector underperformed on Thursday. Techs had another strong day with the Networking iShares (IGN) surging 2% and the Semiconductor SPDR (XSD) gaining 1.62%. The intraday breadth indicators remain bullish overall. Even though the Nasdaq AD Line has yet to clear its early March high, the Nasdaq AD Volume Line and NYSE AD Line did forge new highs this week.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Fri - Mar 21 - 09:00 - Happy Friday!

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.