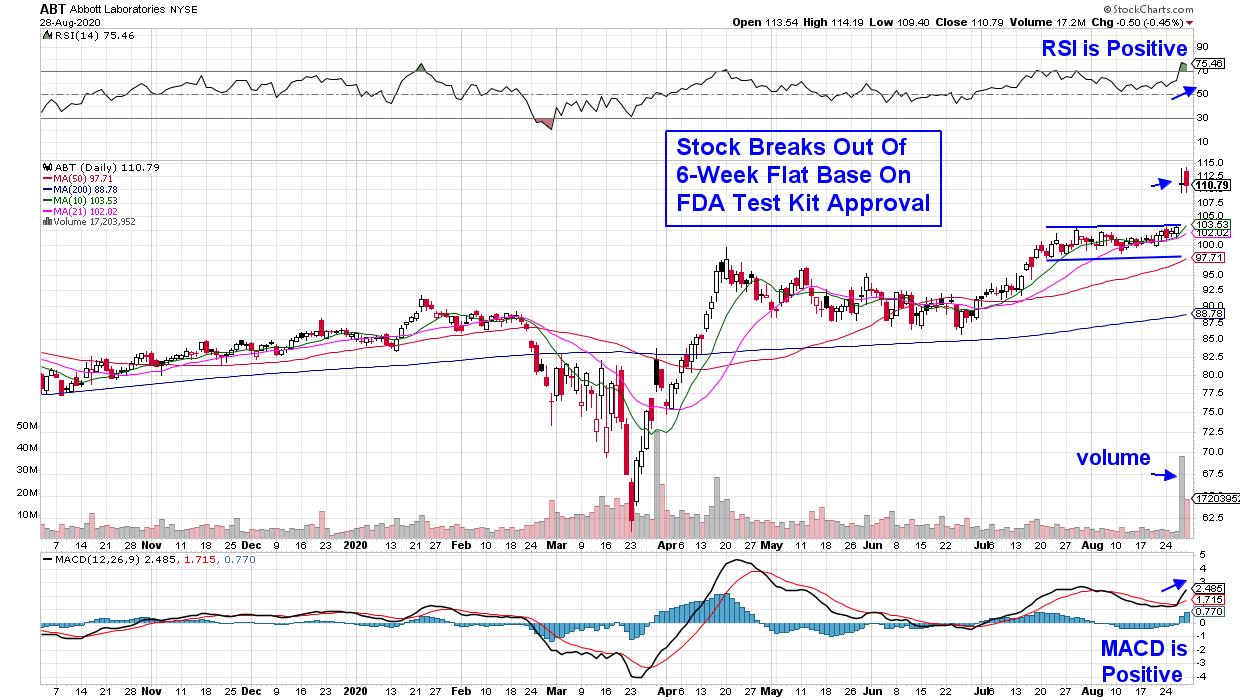

Shares of Abbott Laboratories (ABT) jumped 8% Thursday on news that the FDA granted emergency use authorization for their COVID-19 testing kit.

Abbott's test is a game-changer as it is rapid, reliable and affordable and can detect active coronavirus at massive scale. At a cost of $5 and with a 15-minute result time, the news sparked a sharp rally in many Airline, Cruise and Movie Theatre stocks that would benefit from reliably fast analysis of virus cases.

DAILY CHART OF ABBOTT LABORATORIES (ABT)

While ABT may consolidate a bit here following its gap up in price, signs of expected heavy demand for their kits will easily spur further upside. The company is planning to produce as many as 50 million tests per month starting in October.

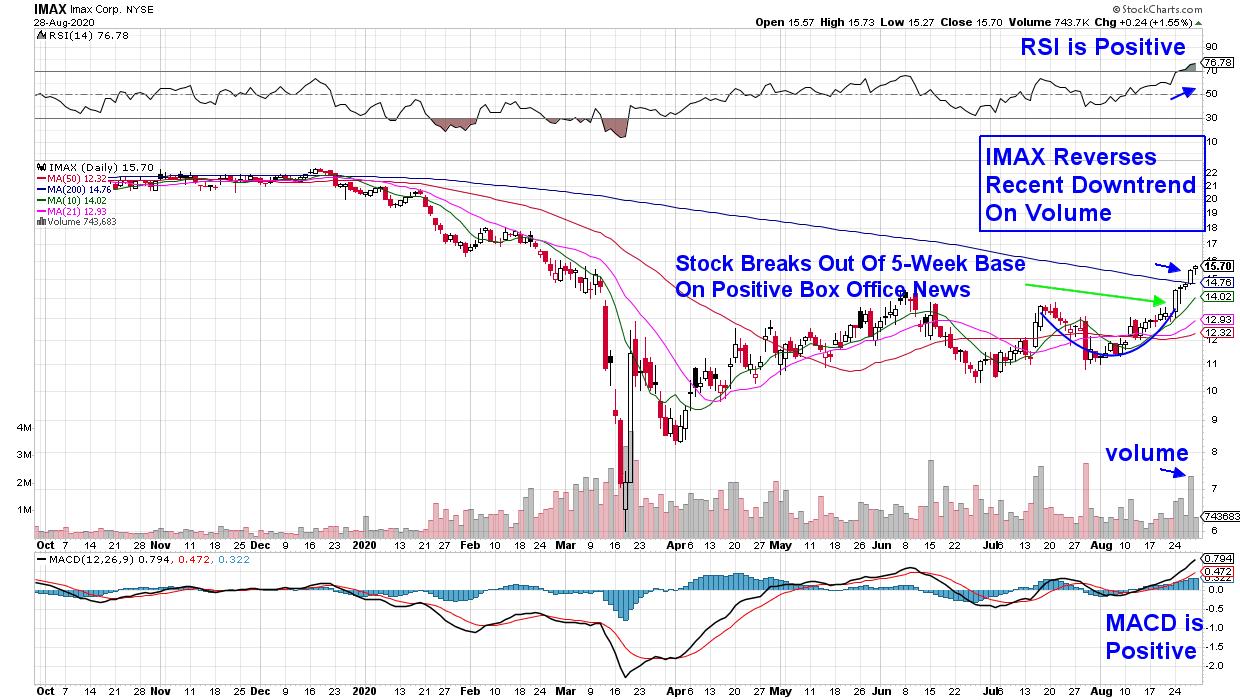

Below is a chart for Movie Theatre company Imax Corp. (IMAX), which reversed its 6-week downtrend following Thursday's break back above a downward trending 200-day moving average. The fact that the move occurred on volume is quite positive.

DAILY CHART OF IMAX CORP. (IMAX)

IMAX not only rallied on positive COVID testing news that pushed the stock into an uptrend, but the stock rallied strongly earlier in the week after reporting impressive box office results from their first major theatrical release in China. This country accounts for 46% of the company's global screen base and last week's news pushed the stock out of a 5-week base on Monday.

The RSI is in an overbought position, which may signal a slight pullback, but its positive position, as well as the MACD, bode well for further upside.

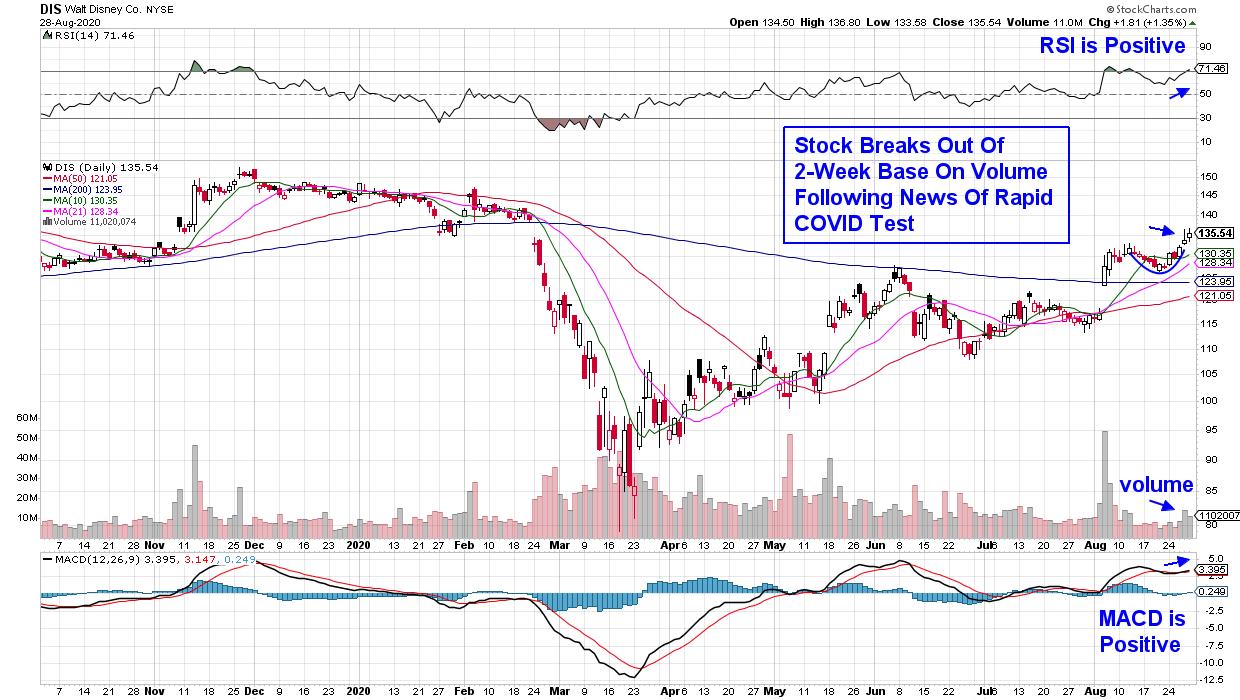

DAILY CHART OF WALT DISNEY CO. (DIS)

Walt Disney Co. (DIS) broke out of a 2-week base this week following news that foot traffic has picked up at their Walt Disney World location. While traffic is still down considerably from pre-pandemic levels, news of improved testing possibilities helped push the stock even higher, with DIS ending the week with a 6.5% gain.

Disney (DIS) is one of the country's largest and oldest media companies, and an even stronger near-term catalyst for growth is their pivot to direct-to-consumer streaming. Disney is expected to generate $11 billion in revenues from this division, and their unconventional decision to release their new film Mulan online next week has investors excited.

While Airline and Cruise stocks rallied, they remain below key longer-term moving averages, which may act as upside resistance. Instead, my work screens for stocks that are trading above their key simple moving averages, with the company currently seeing growth from a high demand for their products.

My bi-weekly MEM Edge Report focuses on even higher growth names than this article highlights with precise entry and exit points that subscribers agree, have helped them greatly outperform the markets. Check out our track record here!

And right now, you can take a 4-week trial of this top performing MEM Edge Report at a nominal fee. You'll receive insights into Industries and Sectors experiencing strong growth, as well as entry points into select stocks from those areas that are poised to take off.

Warmly,

Mary Ellen McGonagle, MEM Investment Research