ChartWatchers December 31, 2021 at 12:16 PM

Here we are, on the last day of the year, writing my last ChartWatchers newsletter contribution for 2021. By the time you are reading this, it will be 2022. So let me kick off by..... Read More

ChartWatchers December 24, 2021 at 05:01 PM

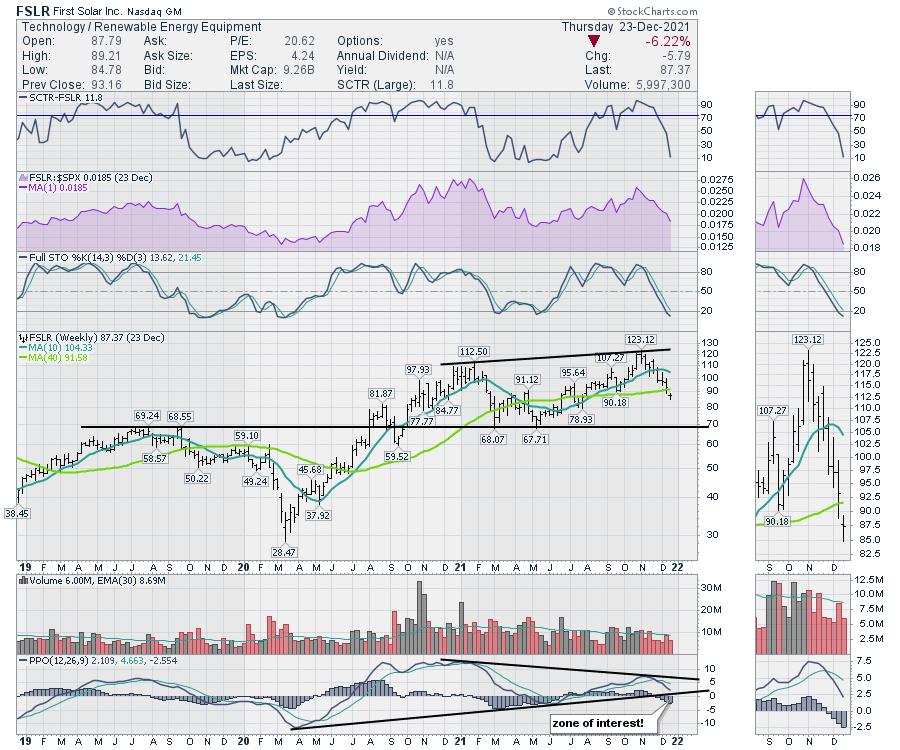

While charting is always an interesting look back, it looks like the solar charts have had a bit of shade, with two real peaks and valley's in 2021... Read More

ChartWatchers December 24, 2021 at 04:00 PM

Last week, I pointed out three charts that had triggered bullish signals and suggested that these characteristics were strong enough to power the market higher. Prices immediately sold off, but have subsequently rebounded... Read More

ChartWatchers December 24, 2021 at 01:43 PM

When the S&P hit a record high on November 22, then proceeded to fall over 5% in just over a week, a lot of pundits declared the market was dead... Read More

ChartWatchers December 24, 2021 at 11:53 AM

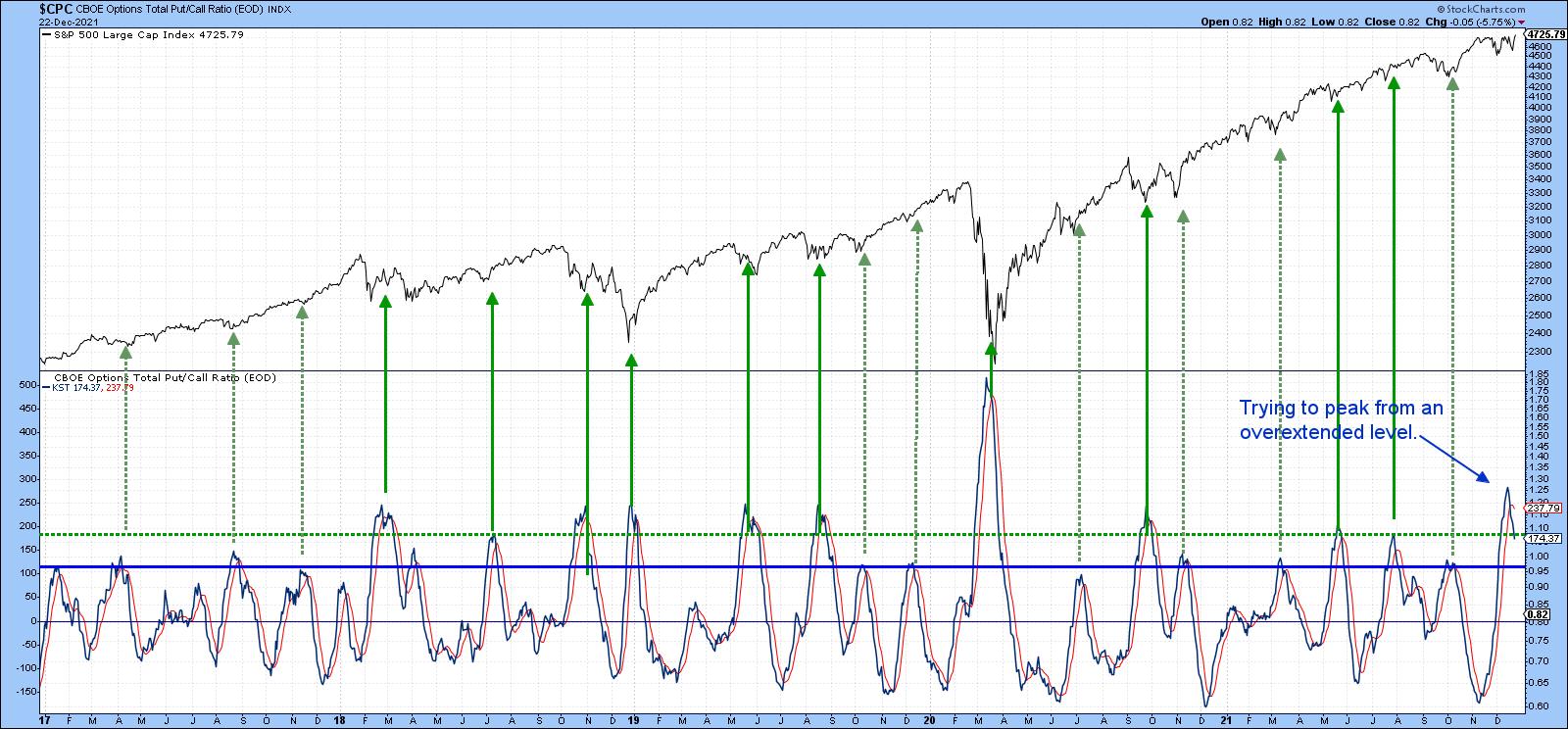

It might take more than Old Saint Nick to sustain this current stock market rally. I'm not a believer this year. It reminds me of that catchy holiday tune: "StockCharts is making a chart and I've checked it twice, gonna find out that Wall Street's naughty, not nice... Read More

ChartWatchers December 24, 2021 at 03:27 AM

The Networking ETF (IGN) is leading the market with a solid uptrend and a new high this week. Diving into the group, I found a stock that recently broke out and formed a short-term bullish continuation pattern... Read More

ChartWatchers December 23, 2021 at 06:07 PM

This week in the subscriber-only DecisionPoint Diamond Mine trading room Thursday morning, I found two industry groups to watch... Read More

ChartWatchers December 17, 2021 at 11:58 PM

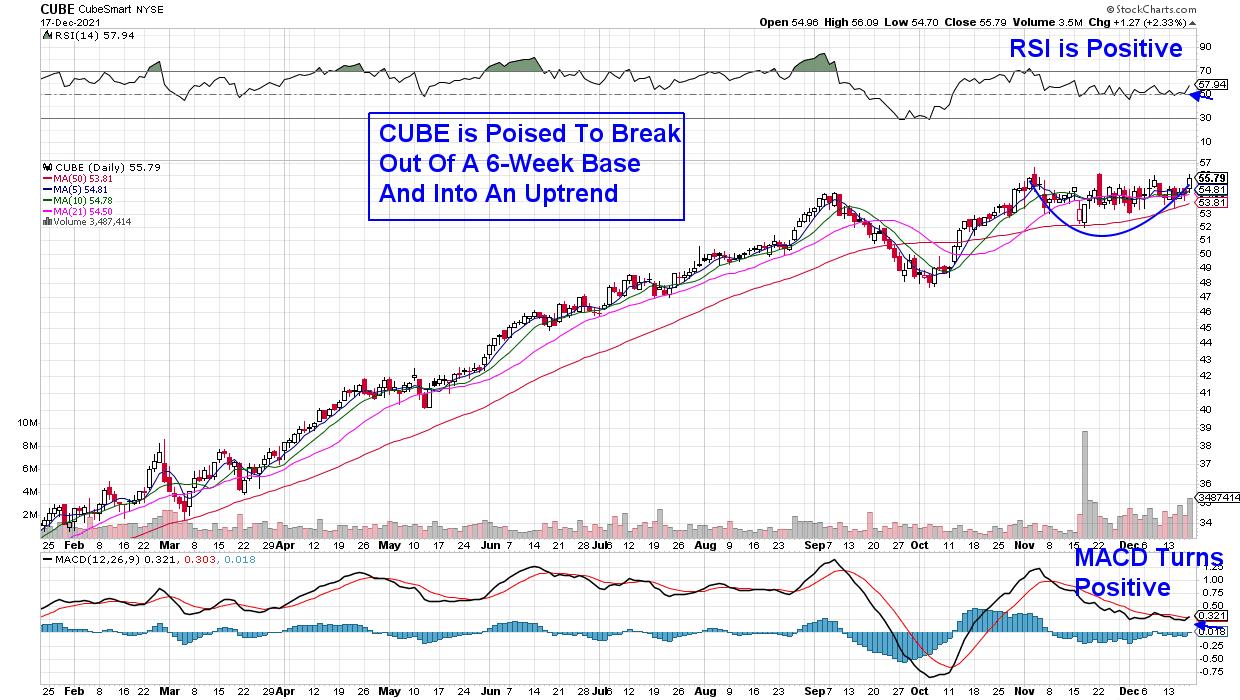

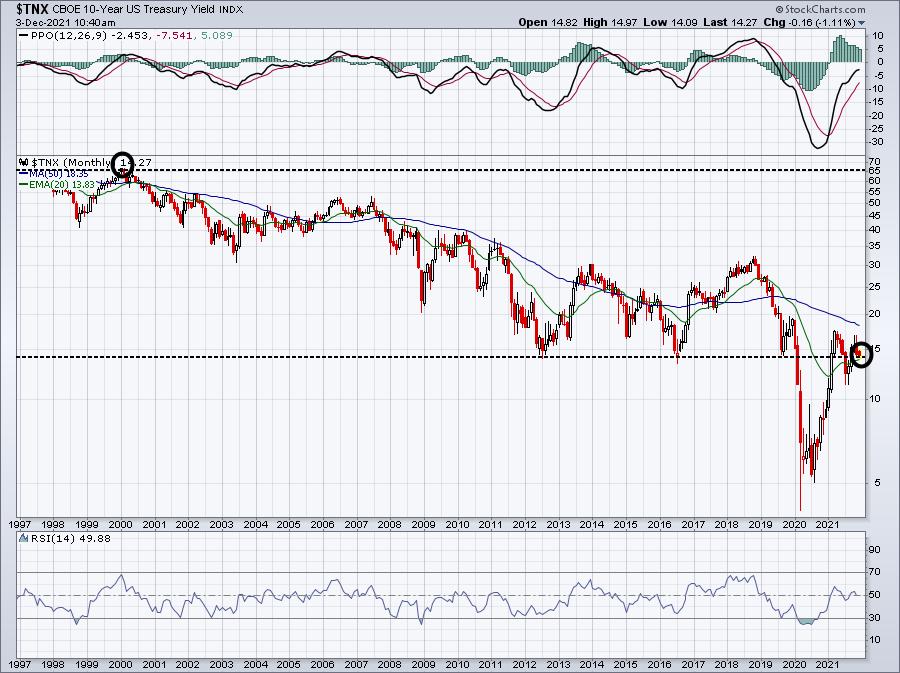

Last week, the Federal Reserve announced plans to shift to a tighter monetary policy to allow for interest rate hikes sooner than expected. The move is in an effort to keep inflation from spiraling out of control and was in response to reports of a surge in inflation... Read More

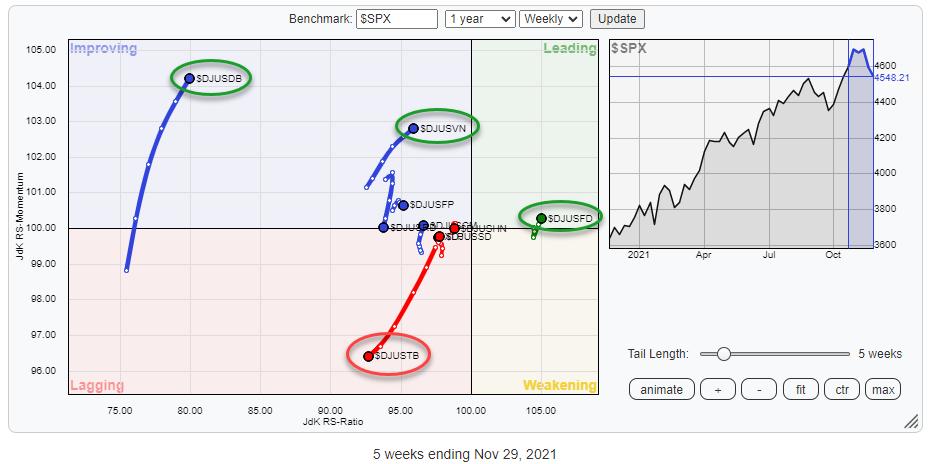

ChartWatchers December 17, 2021 at 06:42 PM

One of the predefined universes/groups on the RRG page is for Growth/Value. Many investors look at this relationship to help them determine whether the market is in a risk-on or risk-off mode. Just pull down the "Groups" selection box and look for Growth / Value... Read More

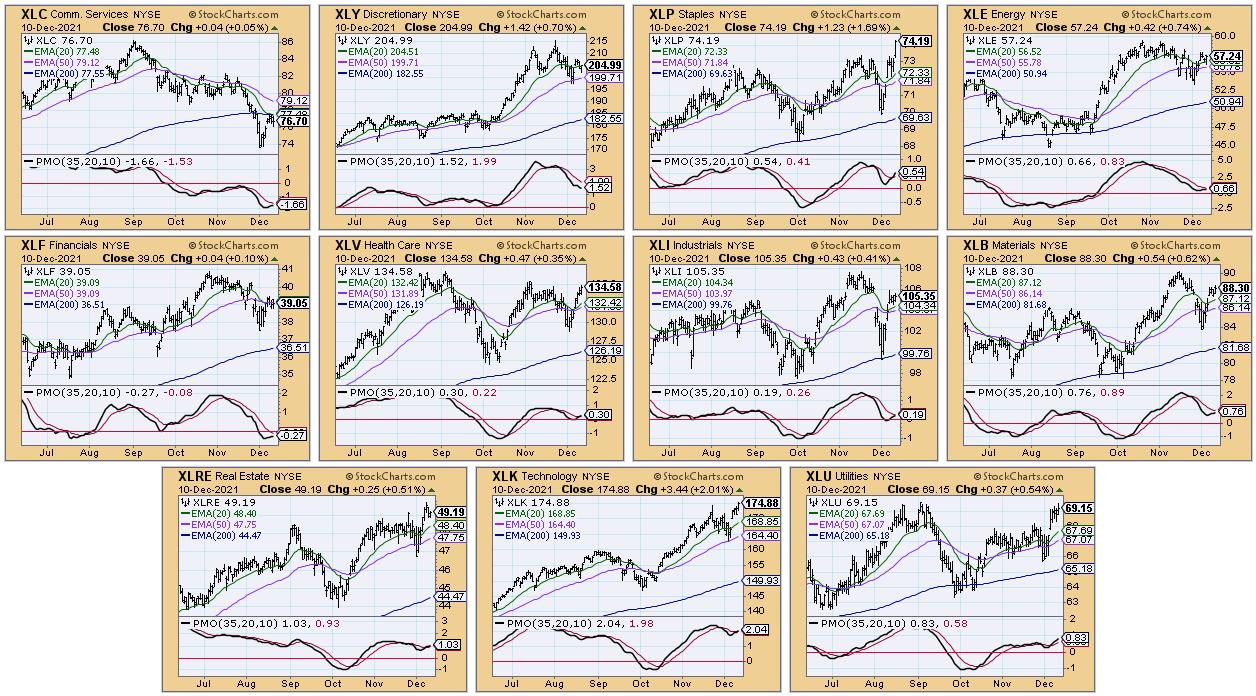

ChartWatchers December 10, 2021 at 07:44 PM

One of the tools we use at DecisionPoint to review sector performance and strength a CandleGlance with our PMO and key moving averages. It wasn't too long ago that every sector was displaying negative momentum... Read More

ChartWatchers December 10, 2021 at 06:51 PM

The market has been under pressure the past several weeks after all of the major indexes hit record highs during November. The NASDAQ has particularly had a tough time getting back on track and it's hard to imagine any Santa Claus rally without the participation of tech stocks... Read More

ChartWatchers December 10, 2021 at 06:33 PM

When the market is spiking up and down like it has recently, it can be hard to read through to areas of strength. One area that I have been keeping an eye on is the materials space, as many of the names have been consolidating since May... Read More

ChartWatchers December 10, 2021 at 05:05 PM

The Oil & Gas Equipment & Services ETF (XES) was one of the leading industry group ETFs in the spring after it surged some 164% off its November low. This was clearly a massive gain and the ETF was entitled to a rest... Read More

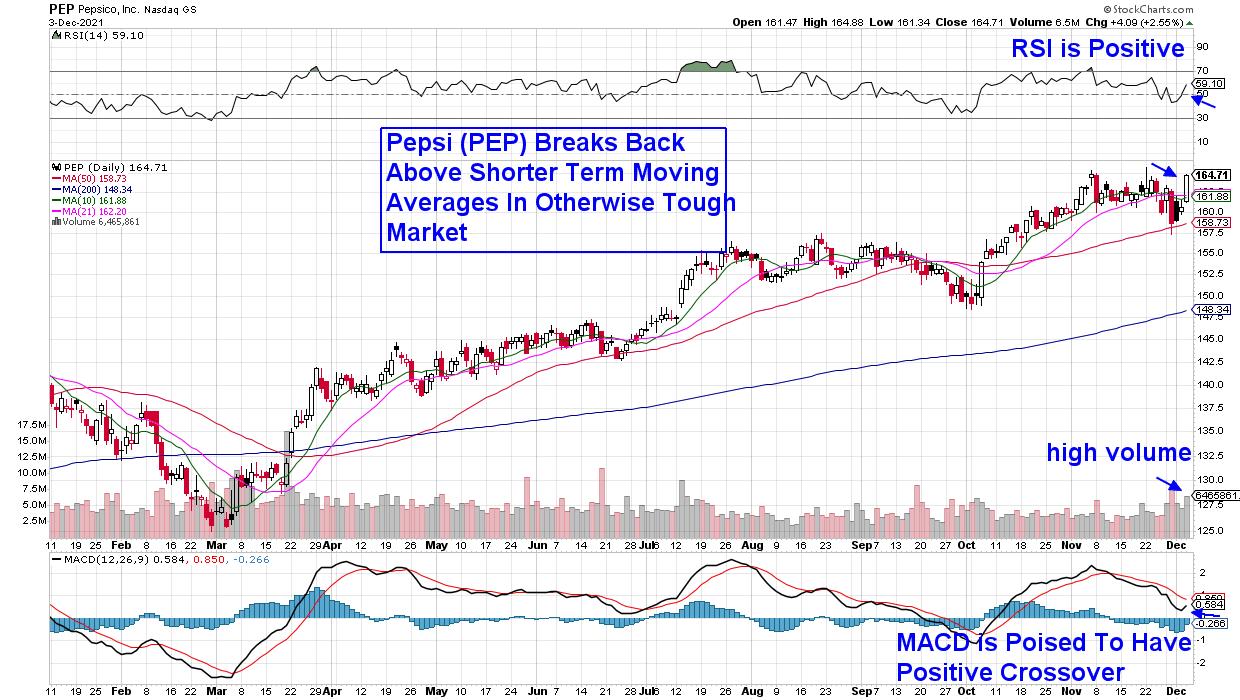

ChartWatchers December 04, 2021 at 12:33 AM

The S&P 500 closed the week below its key 50-day moving average as investors sold stocks in the face of omicron and inflation fears. The Nasdaq also dropped in a move that pushed this Index below key support as well and into negative territory... Read More

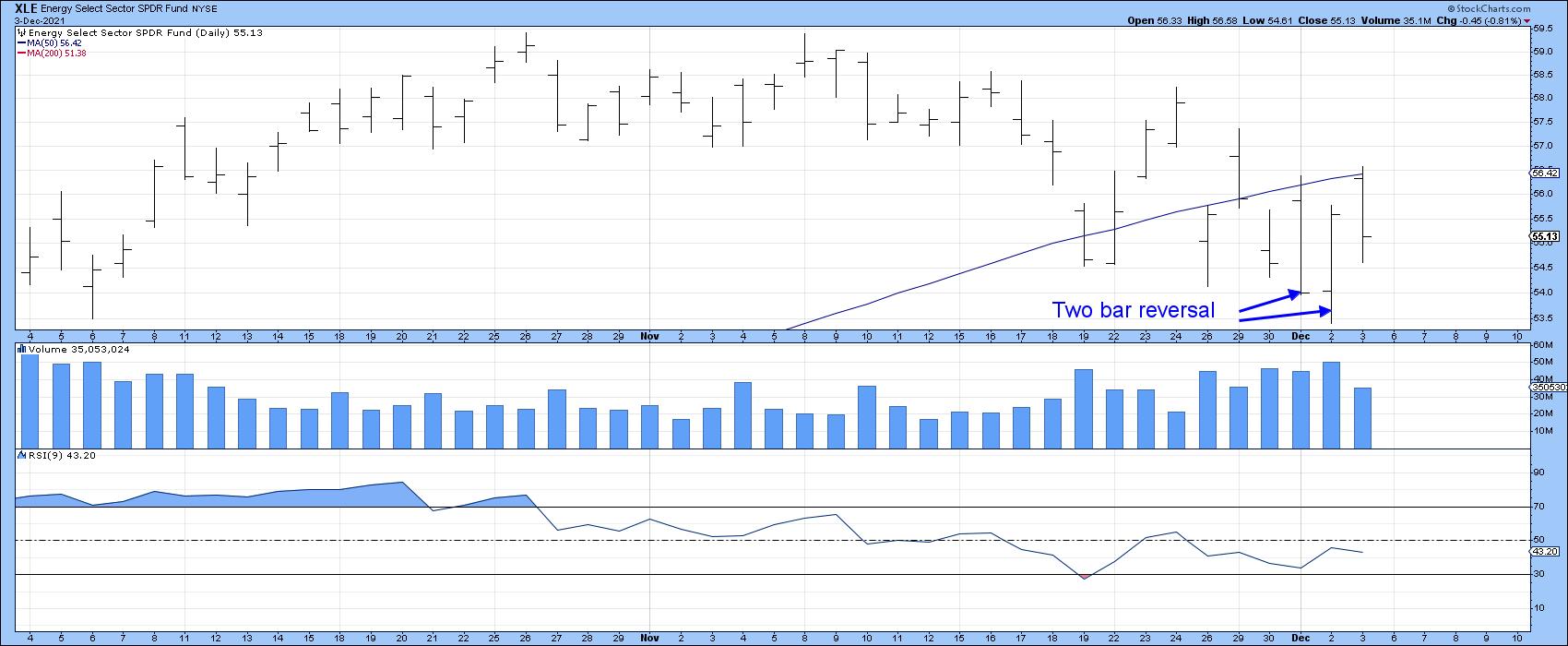

ChartWatchers December 03, 2021 at 07:58 PM

Thursday's action was quite positive for several sectors, as they experienced positive two-day price formations. These patterns are only of a short-term nature and usually have an effect for between 5 and 10 days, so they do not represent major signals... Read More

ChartWatchers December 03, 2021 at 06:51 PM

The S&P 500 is still holding up inside the boundaries of its rising channel, but the market is nervous, which resulted in a VIX reading above 30. That hasn't happened since February... Read More

ChartWatchers December 03, 2021 at 12:02 PM

I practiced in public accounting for 20 years and was involved in a number of company valuations. I worked very little with public companies, but did have to value private companies on occasion... Read More