ChartWatchers May 20, 2022 at 11:44 PM

I've been warning all year about this cyclical bear market and, unfortunately, it's not over just yet. Sentiment is turning more and more bearish, which is good, but we haven't seen the peak to mark the market bottom. That will take time and patience... Read More

ChartWatchers May 20, 2022 at 10:38 PM

The markets have fallen for seven consecutive weeks, with the S&P 500 having its worst period in over 20 years (which was back when investors were grappling with the dot-com bubble burst)... Read More

ChartWatchers May 20, 2022 at 07:31 PM

For a bird's eye view of developments in international stock markets, I use a Relative Rotation Graph that shows the rotations for a group of international stock indexes. The RRG below shows the weekly rotation for this group... Read More

ChartWatchers May 13, 2022 at 09:06 PM

The following is a complimentary copy of Friday's subscriber-only DP Weekly Wrap. Want this content in your email box every market day? Subscribe to the DP Alert without delay! It was a volatile trading week, with investors breathing a sigh of relief on today's positive close... Read More

ChartWatchers May 13, 2022 at 06:54 PM

Tech shares have been pounded for the last 6 months after making their highs in November. This week, we saw some significant lows. The Nas-dawg 100 was down 30%. That's not 30% of the gains since 2020 -- that's 30% of the whole price. That is a massive haircut... Read More

ChartWatchers May 13, 2022 at 06:16 PM

The carnage in the market, which has resulted from the 30% decline in the NASDAQ since its November 22, 2021 high, is going to be remembered for a long time, especially by those who painfully held on to stocks that, in some cases, fell 50% or more from their all-time highs... Read More

ChartWatchers May 13, 2022 at 09:56 AM

The bigger trend is one of the most important factors to consider when trading stocks or ETFs. We can use trend signals as part of a trend-following strategy or to dictate our trading bias. I look for bullish setups and pullback opportunities when the trend is up... Read More

ChartWatchers May 06, 2022 at 11:45 PM

As we closed out 2021, I began discussing sentiment and its need for a "reset." We had moved higher for the better part of two years, and the U.S. stock market had picked up a lot of new "post-pandemic" investors and traders... Read More

ChartWatchers May 06, 2022 at 10:46 PM

It's been an extremely tough period for the markets over the past 2 weeks, with oversold rallies giving way to major selling... Read More

ChartWatchers May 06, 2022 at 07:18 PM

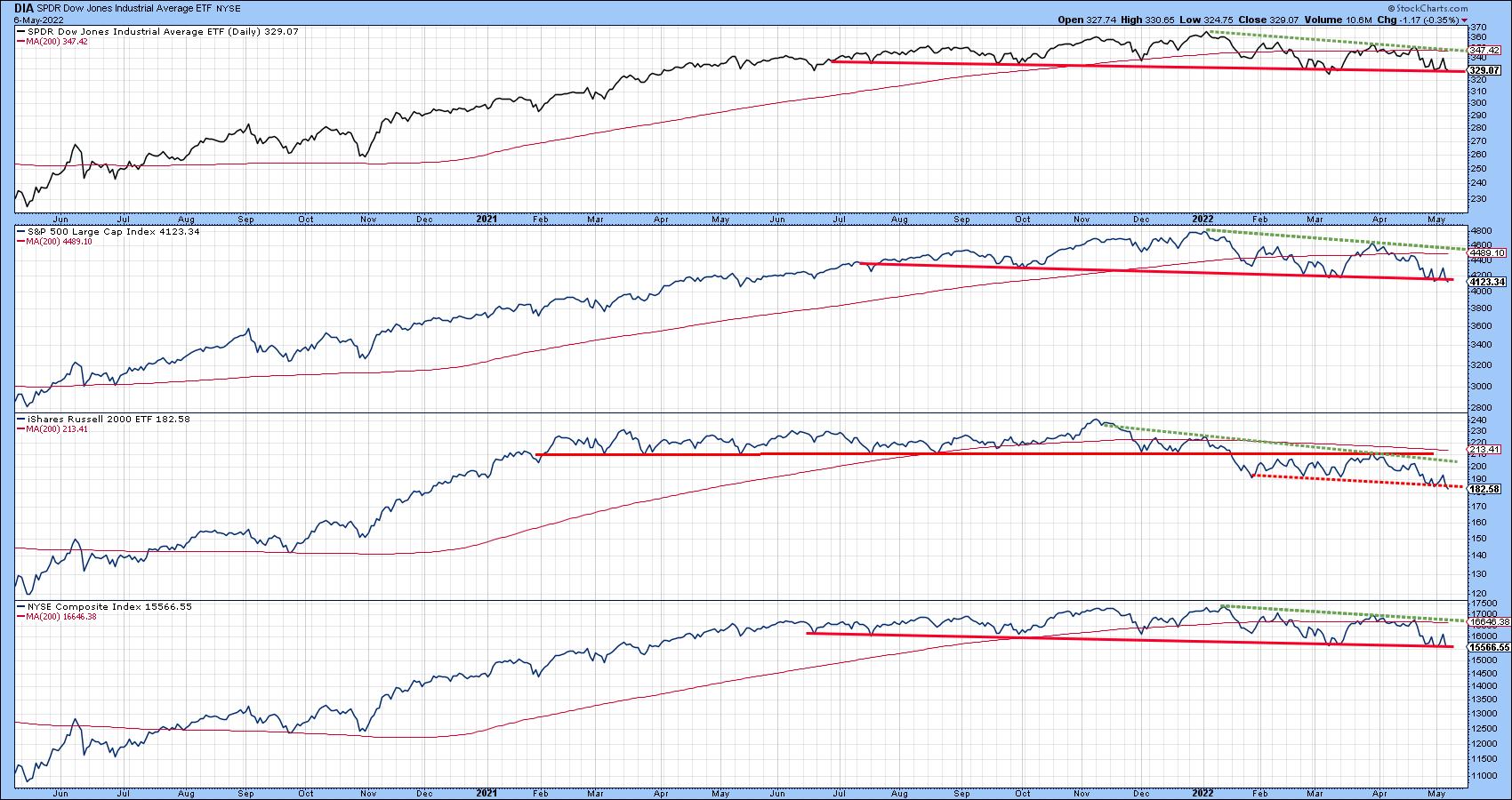

Chart 1 reflects the fact that some market averages are on the edge of a cliff, in the form of major support trendlines marking the lower edges of potential top formations... Read More

ChartWatchers May 06, 2022 at 06:56 PM

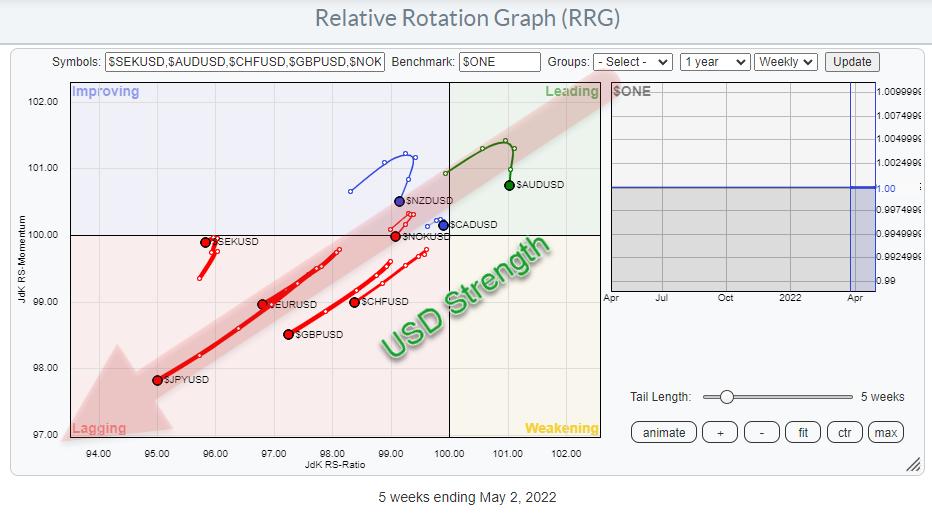

The Relative Rotation Graph that shows the rotation for currencies against the USD as the base is sending us a very clear picture! USD Strength The graph holds the G10 currencies... Read More