Market Recap for Monday, April 1, 2019

U.S. equities had a stunning first quarter and Monday was an encore to open up Q2. Keep in mind that we’ve entered the most bullish period within April historically as the NASDAQ has produced annualized returns of +21.45% from April 1 through April 18 since 1971. If we strip out April 13and 14, which are typically down days (perhaps to raise cash for April 15 income taxes?), the annualized return jumps to 31.17%. It’s not unusual for the stock market to make a significant run higher into the start of quarterly earnings season.

From an index perspective, there was no real clear leadership as each major index rose between 1.06% (Russell 2000) and 1.29% (NASDAQ). Financials (XLF, +2.45%) and industrials (XLI, +2.07%) were the obvious sector winners, however, as a suddenly rising 10 year treasury yield ($TNX) resulted in a bounce in the two aggressive sectors that had been underperforming on a relative basis in 2019 as the TNX plummeted:

A couple of points to be made here. First, note the pink line that’s placed underneath the XLF:$SPX price relative line. It clearly shows that the declining TNX has had a major impact on the relative performance of financials. The blue circles, however, show that the relative strength in both the XLF and XLI have picked up as money has rotated away from treasuries. Finally, if the XLF could break above its March high just above 27, it would be a bullish break above neckline resistance that would likely lead to a much more significant gain in financials.

A couple of points to be made here. First, note the pink line that’s placed underneath the XLF:$SPX price relative line. It clearly shows that the declining TNX has had a major impact on the relative performance of financials. The blue circles, however, show that the relative strength in both the XLF and XLI have picked up as money has rotated away from treasuries. Finally, if the XLF could break above its March high just above 27, it would be a bullish break above neckline resistance that would likely lead to a much more significant gain in financials.

Retail sales were very weak in February, but the S&P Retail ETF (XRT, +0.64%) managed to gain ground, primarily because January retail sales were revised higher to offset the February shortfall.

Defensive stocks lagged badly, led by utilities (XLU, -0.69%). In an unrelated note, one of the most highly anticipated IPOs of 2019 – Lyft (LYFT, -11.85%) - tumbled for a second straight day after opening above 87 on Friday afternoon. The close of 69.01 was below the IPO price of 72. Expect more volatility ahead for LYFT.

Pre-Market Action

Since my article is published during the trading day, no pre-market action is being provided here.

Current Outlook

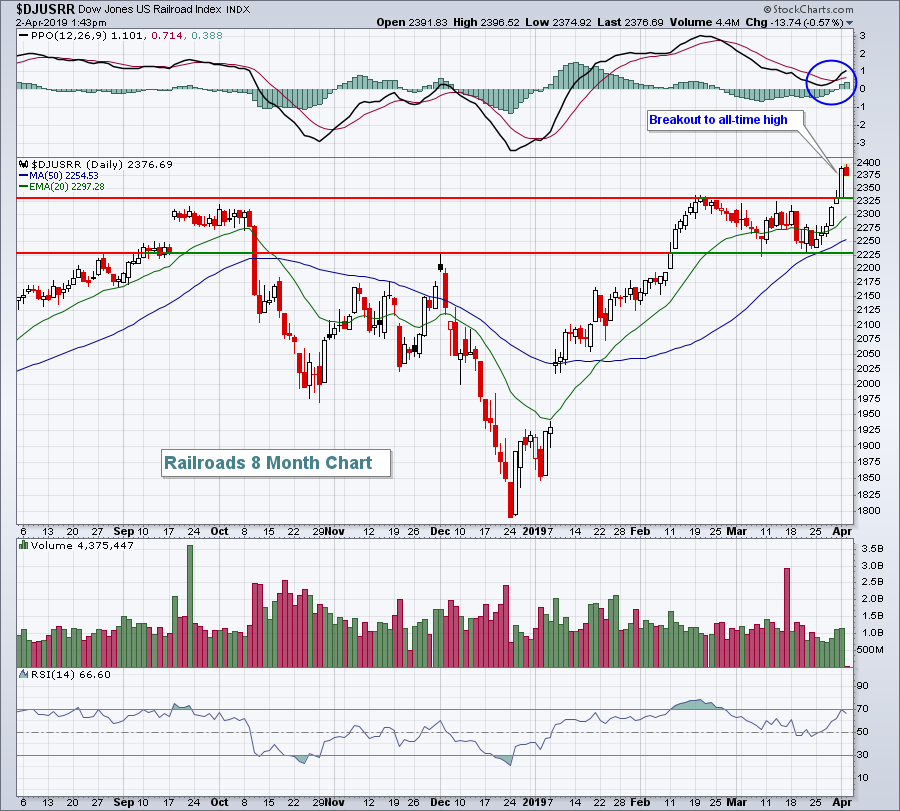

A lot has been written and said about the Dow Jones Transportation Average ($TRAN) not participating in the current rally to the extent many other areas have. While that’s true to some extent, it’s important to note that the Dow Jones U.S. Railroads Index ($DJUSRR), a proxy for the U.S. economy, has been sailing along and broke out again on Monday to an all-time high:

It’s very difficult to be bearish about U.S. equities when railroads are performing well.

It’s very difficult to be bearish about U.S. equities when railroads are performing well.

Sector/Industry Watch

The consumer staples sector (XLP, -0.34%) hit price resistance that was established in November 2018 and backed off yesterday. It’s a defensive sector and those defensive areas did not perform well on Monday. Yesterday’s open now establishes the key resistance to watch, while the rising 20 day EMA should provide support:

So currently, let’s watch the 54.94-56.22 range to see which level gives way first.

So currently, let’s watch the 54.94-56.22 range to see which level gives way first.

Historical Tendencies

Yesterday, I discussed the bullishness of the 1stcalendar day of the month on the S&P 500 dating back to 1950. The 2ndand 3rdcalendar days aren’t too shabby either:

2nd: +35.85%

3rd: +26.48%

Key Earnings Reports

(actual vs. estimate):

WBA: 1.64 vs 1.70

Key Economic Reports

February durable goods released at 8:30am EST: -1.6% (actual) vs. -1.8% (estimate)

February durable goods ex-transports released at 8:30am EST: +0.1% (actual) vs. +0.0% (estimate)

Happy trading!

Tom