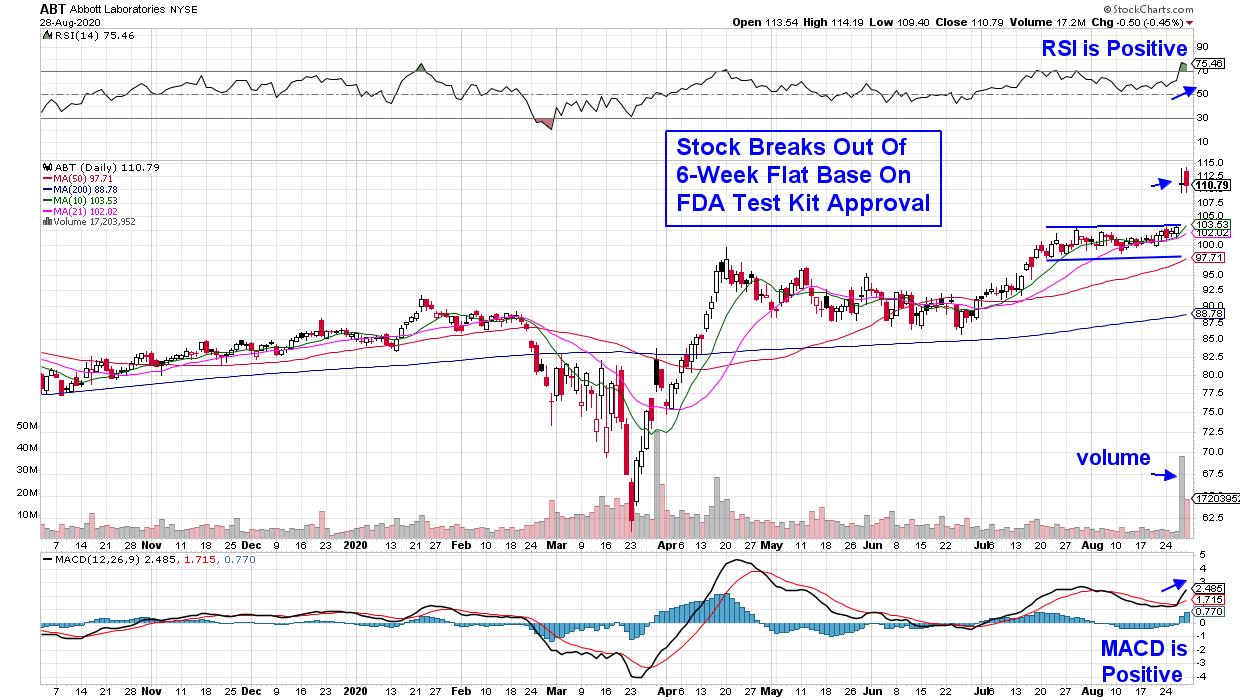

ChartWatchers August 28, 2020 at 10:50 PM

Shares of Abbott Laboratories (ABT) jumped 8% Thursday on news that the FDA granted emergency use authorization for their COVID-19 testing kit. Abbott's test is a game-changer as it is rapid, reliable and affordable and can detect active coronavirus at massive scale... Read More

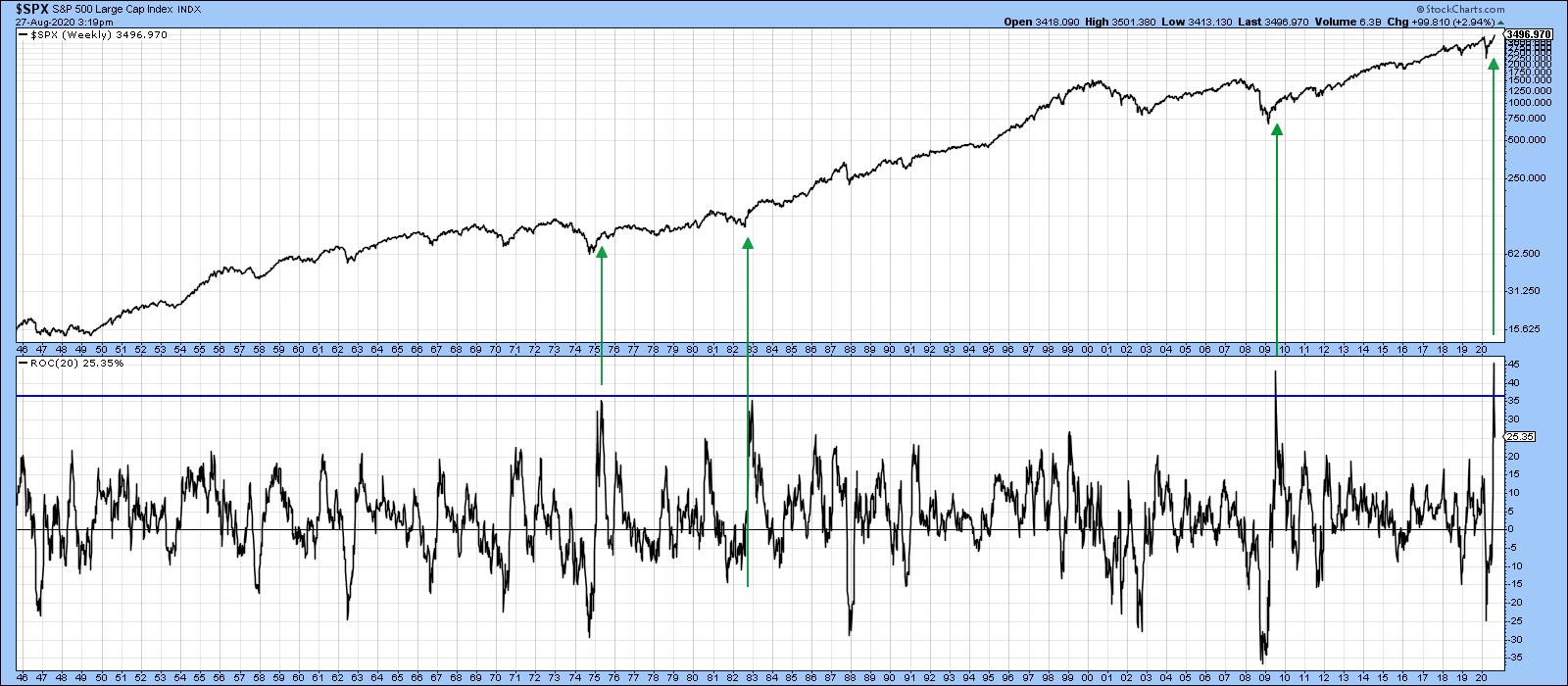

ChartWatchers August 28, 2020 at 09:00 PM

Strong Bull Market Indications We are all aware of the Shakespearian saying "Beware of the Ides of March," which didn't go so well for Julius Caesar. In market folklore, October is the season for crashes and September is the worst-performing month... Read More

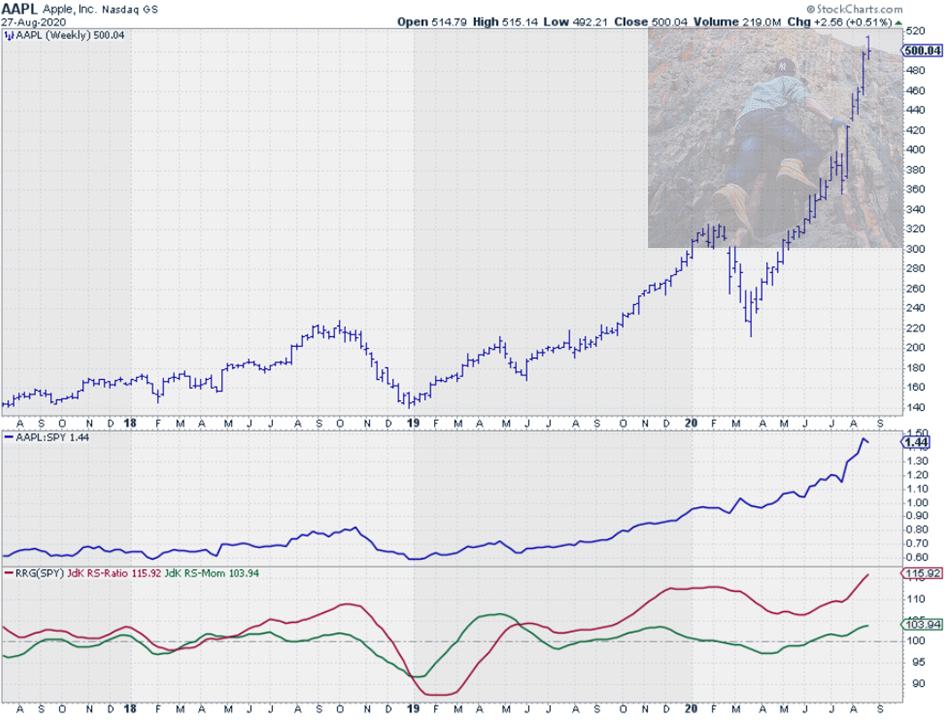

ChartWatchers August 28, 2020 at 04:11 PM

If you've followed my work, you know three things. First, I'm one of the few analysts that kept my long-term secular bull market call intact despite the pandemic-induced selloff back in March... Read More

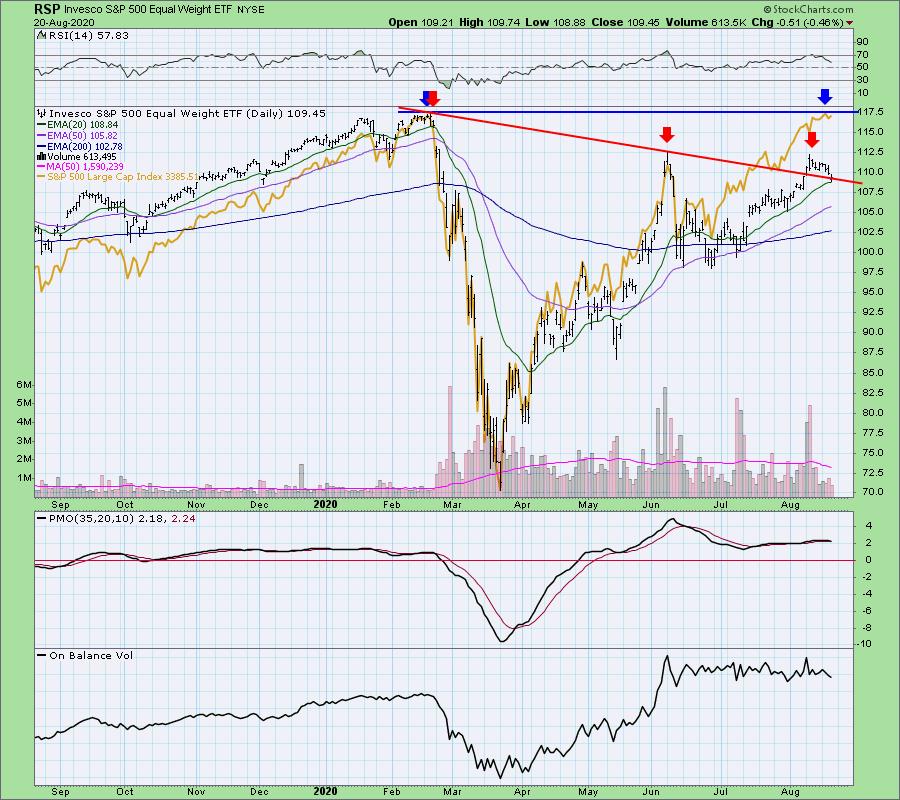

ChartWatchers August 28, 2020 at 03:55 PM

Last week, I wrote an article titled "What Can We Learn From Equal Weight vs. Cap Weighted Rotations on RRG". In that article, I touched upon distortions between EW and CW sector ETFs because of the large and increasing weight of a few Mega-Cap stocks... Read More

ChartWatchers August 21, 2020 at 10:00 PM

Last Friday's message applied Bollinger bands to the S&P 500 and cautioned that the market looked a bit stretched over the short-run... Read More

ChartWatchers August 21, 2020 at 07:49 PM

It's been a very exciting time for the bulls, with the NASDAQ and S&P hitting all-time highs this week. In fact, for those who have been skeptical and sat out the move off of the March 21 bottom, this has been painful to watch, with the NASDAQ rising over 70% in just 5 months... Read More

ChartWatchers August 21, 2020 at 05:24 PM

It has been a ride off the lows. The juggernauts continue to rise into the valuation stratosphere. Because of the large balance sheets in Tech, they have become the defense and the offense for this market... Read More

ChartWatchers August 21, 2020 at 02:28 PM

Yesterday I had the pleasure of doing a podcast with FinancialSense.com's James Puplava (I'll send the link out to the DecisionPoint free email list when I have it - sign up on the DecisionPoint.com homepage)... Read More

ChartWatchers August 21, 2020 at 04:53 AM

The total number of new highs in the S&P 500, S&P MidCap 400 and S&P SmallCap 600 continues to underwhelm. Even so, new highs are still outpacing new lows and this is enough to keep the uptrend since late March going... Read More

ChartWatchers August 15, 2020 at 12:41 AM

The recent pullback in high-growth stocks has created some unique opportunities to purchase select growth names at a discount. Before considering this strategy, however, it's important to make sure that several characteristics are in place... Read More

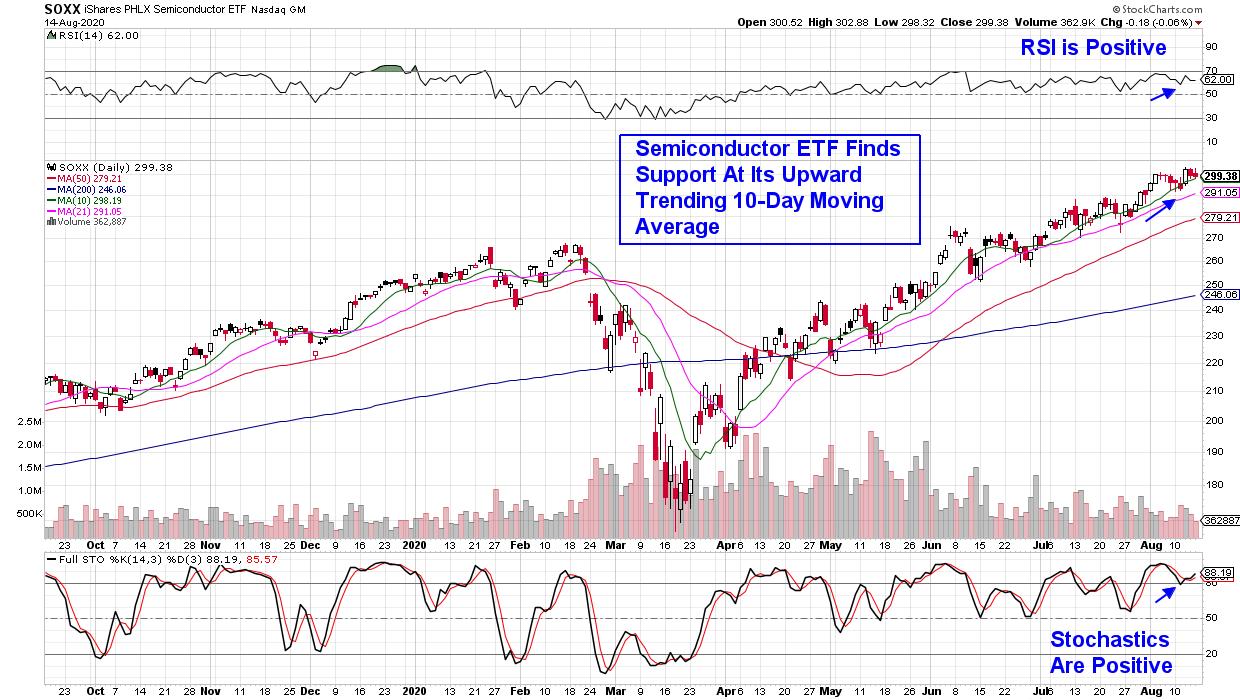

ChartWatchers August 14, 2020 at 08:19 PM

Over the past five months, since that March low, we've enjoyed many stocks' relentless pursuit to the upside. I know it's hard, however, to keep chasing those stocks as their prices move into what seems the stratosphere... Read More

ChartWatchers August 14, 2020 at 06:56 PM

The last five months of market history are a blur for me. Back in mid-March, the S&P 500 was in free fall with no end in sight. Here we are in mid-August, and the S&P is retesting all-time highs... Read More

ChartWatchers August 14, 2020 at 06:39 PM

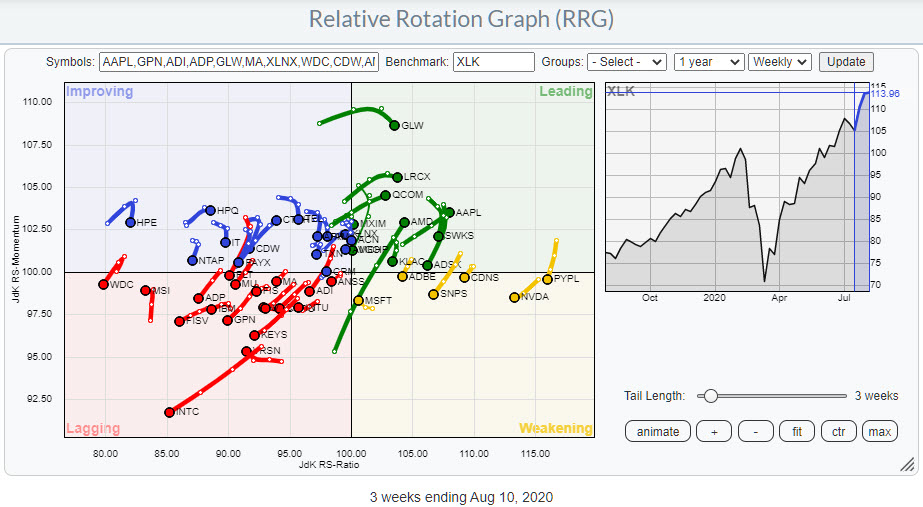

The technology sector sparks a lot of interest, and for good reason - it has turned into a safe(r) haven when things get rough in the markets, but it's also everybody's baby when the market goes up. "What could possibly go wrong?", one would think... Read More

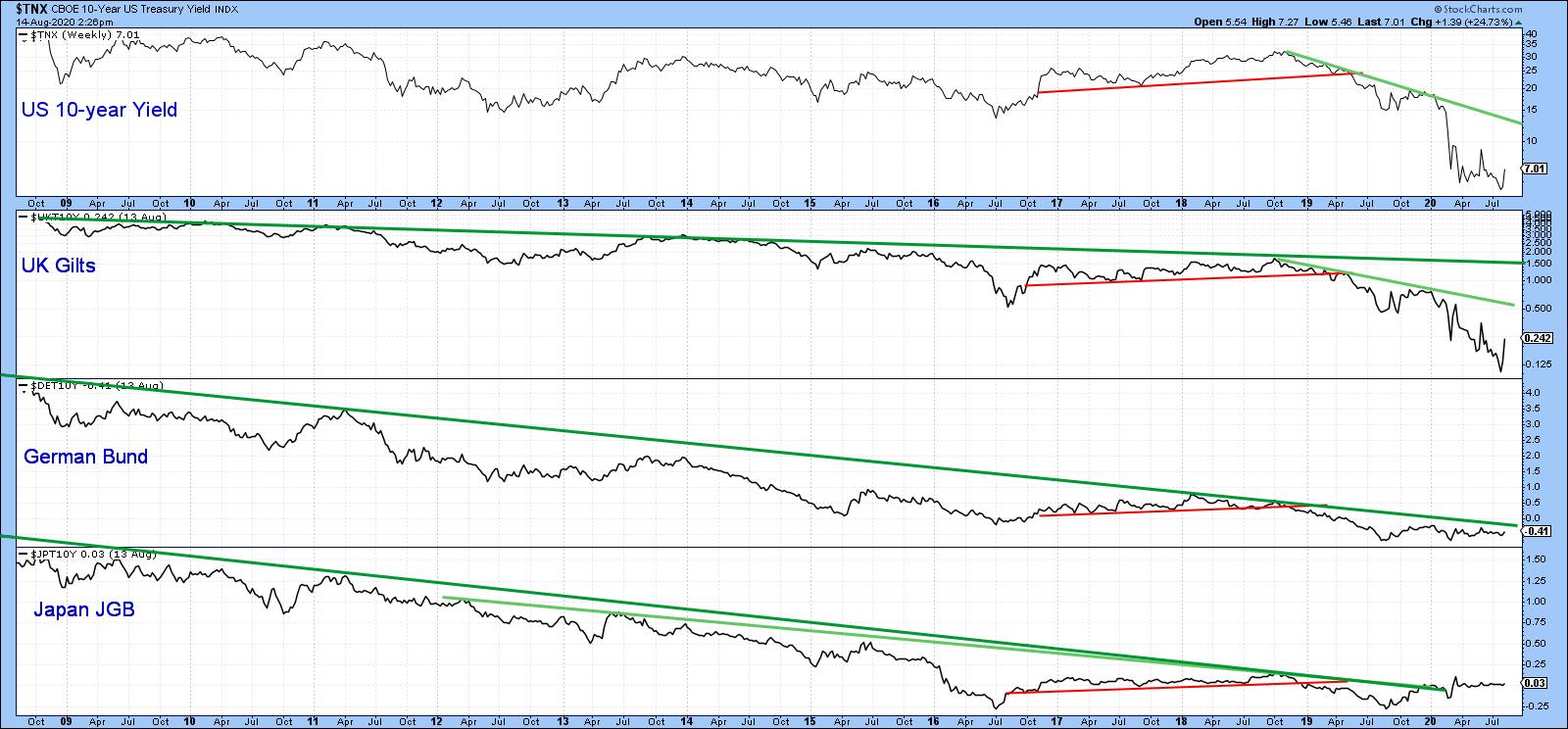

ChartWatchers August 14, 2020 at 03:17 PM

Chart 1 shows that the basic trend for bond yields around the world is still negative, as all series are in a clear-cut downtrend. The only exception is Japan, where the secular down trendline was violated earlier in the year... Read More

ChartWatchers August 08, 2020 at 12:00 AM

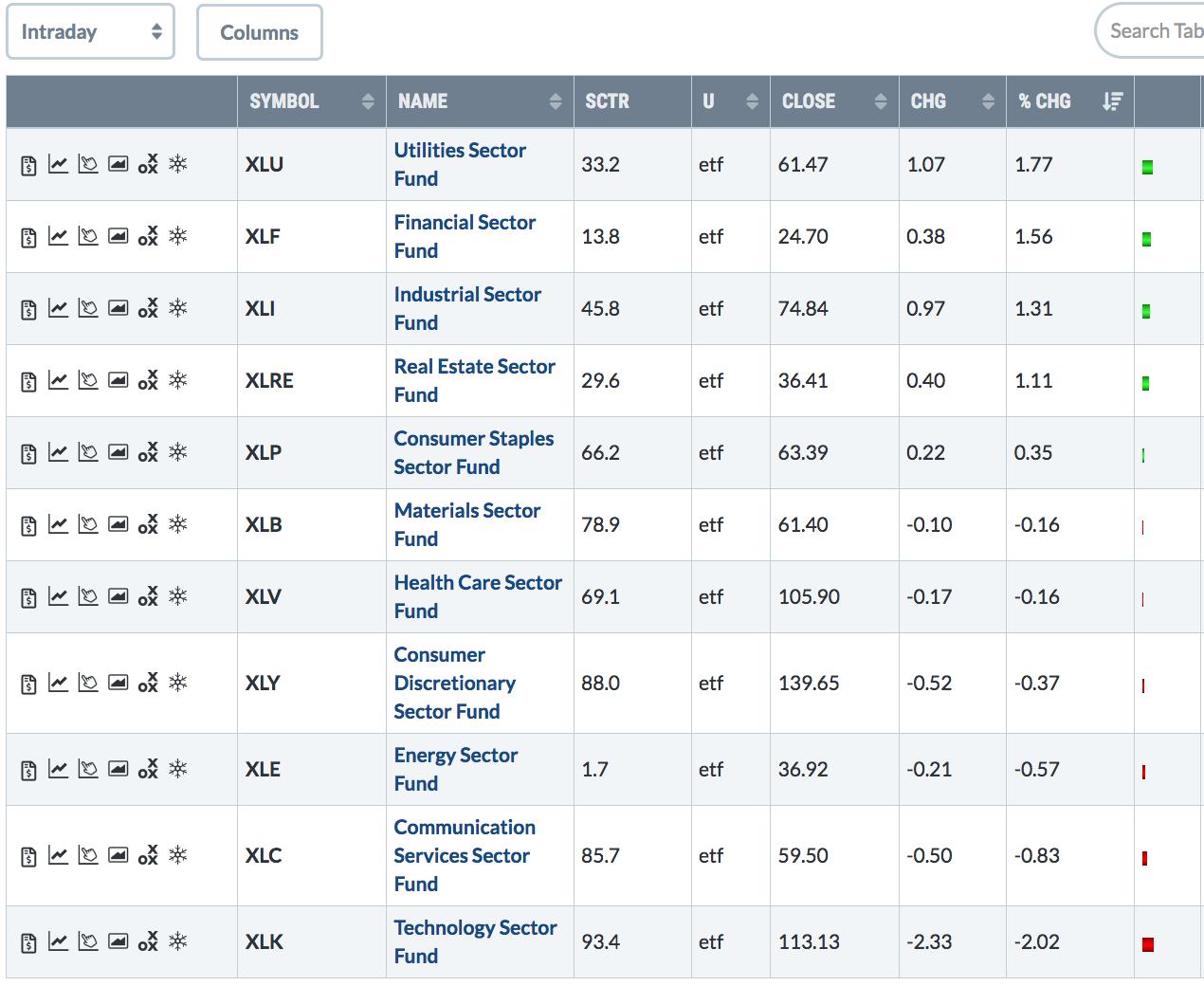

Big tech has been the main story in the market since the start of the pandemic with most of the rest of the market largely left behind... Read More

ChartWatchers August 07, 2020 at 08:13 PM

On Wednesday afternoon, as I was preparing to record the DecisionPoint show, I did a scan of the sectors in preparation and the Industrial Sector SPDR (XLI) caught my eye after a nice gap up... Read More

ChartWatchers August 07, 2020 at 06:38 PM

A number of tech giants have crushed earnings expectations, something that becomes quite apparent when you look at their charts. For example, take a look at Apple (AAPL), which recently reported its numbers: Your eyes are not deceiving you... Read More

ChartWatchers August 07, 2020 at 06:14 PM

It seems remarkable that, every week, the market moves higher regardless of public health deterioration, rising death rates, politics, increasing global conflict, falling earnings and rising bankruptcies... Read More

ChartWatchers August 07, 2020 at 04:35 PM

The Healthcare SPDR (XLV) is one of the strongest sectors in 2020. Even though it does not sport the biggest gain, XLV recorded a new high in July and some 80% of its components are above their 200-day EMAs... Read More

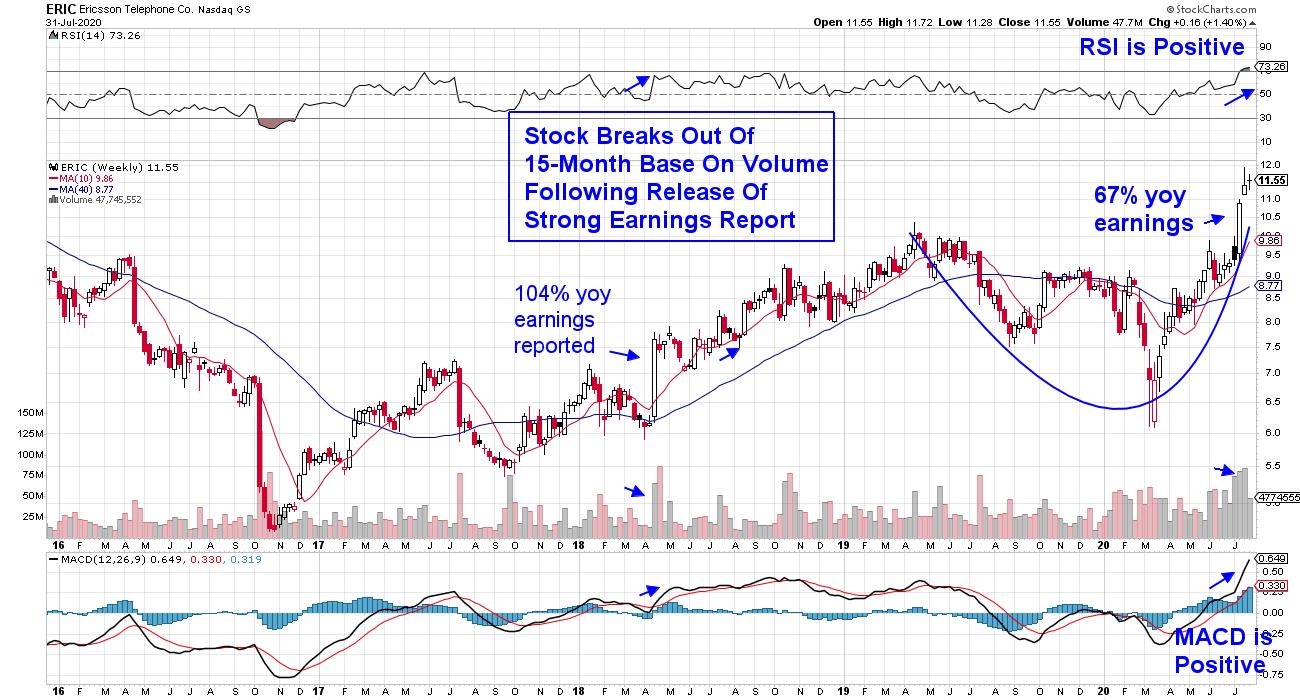

ChartWatchers July 31, 2020 at 11:07 PM

It's been quite a week for the markets and while market news is likely to focus on the explosive gains in select FAANG stocks, I believe there's an even bigger story that's come to light during this surprisingly robust earnings season... Read More

ChartWatchers July 31, 2020 at 11:00 PM

Swings in commodity prices are both a market and an economic indicator. There are certainly exceptions, but when the economy is in a recovery phase, commodity prices generally rise... Read More

ChartWatchers July 31, 2020 at 09:10 PM

Every three months, we fill out our four portfolios with 10 equal-weighted and leading stocks, mostly in leading industries. We combine fundamental research and technical analysis to make our money work harder, which is the whole idea... Read More

ChartWatchers July 31, 2020 at 08:22 PM

This week on The Final Bar, one of our Mailbag questions related to Amazon.com (AMZN) and how far it has reached above its 200-day moving average... Read More